2019 Fourth Quarter Review

SCORECARD

Fed lowered rates 3 times in 2019. Inflation remains low.

Bonds: The U.S. 10-year Treasury yield fell from 2.7% to 1.8% over the course of the year, and the Barclays U.S. Aggregate has returned over 8% year-to-date.

Although at a lackluster 2.3%, the 30-year U.S. Treasury bond yield is higher than all other government debt of developed countries, so buyers might just be buying the best house in a bad neighborhood.

2019 MARKET REVIEW

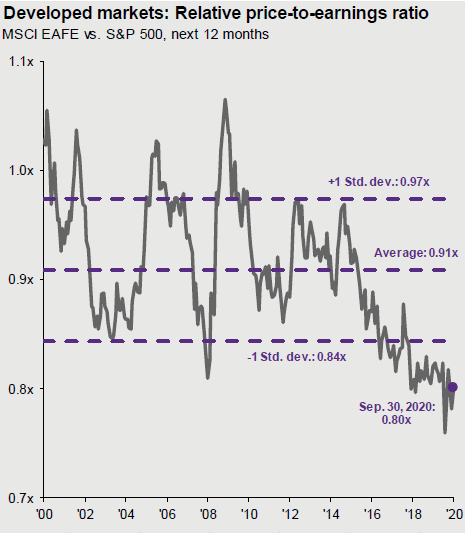

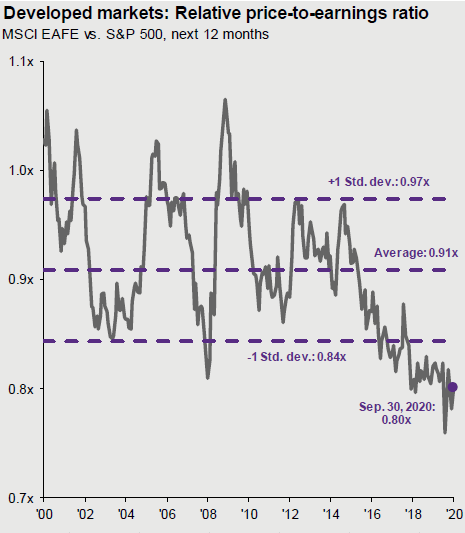

The stock market reached all-time highs in 2019, with all major asset classes positive for the year. U.S. stocks continued to outperform international. The broad-based S&P 500 index was up 31.5%.

Bonds also had a very good year, up 8.72%, but most of that growth was through September.

Yes, gains in 2019 were big, but remember the almost 20% market drop at the end of 2018? The stock market finished 2019 up about 10% from the previous peak in September 2018. Much of the gain in 2019 was making up ground from the sell-off at the end of 2018.

MOST COMMONLY ASKED QUESTION LAST QUARTER

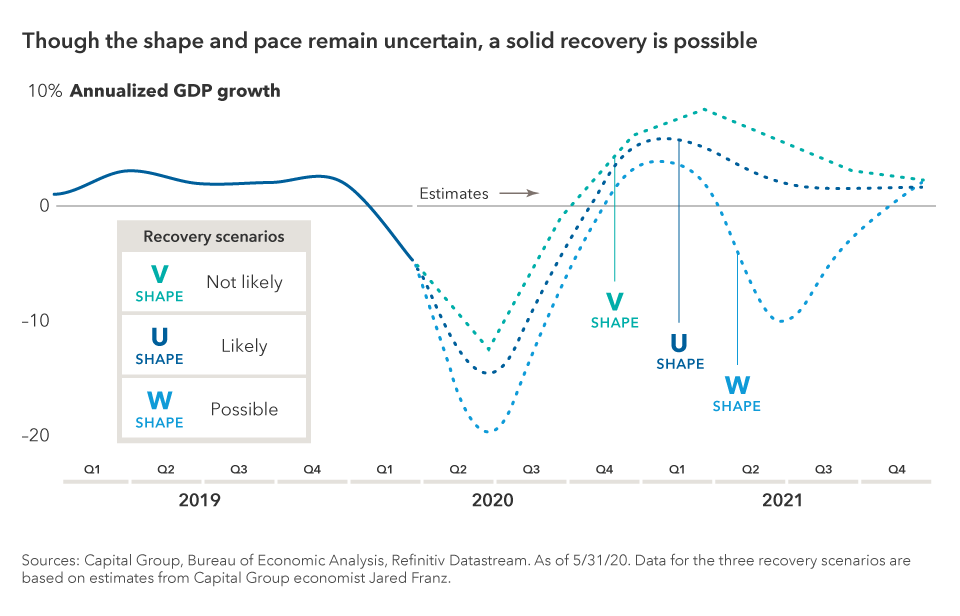

What will the market do in 2020?

The first quarter of a new year and a new decade brings questions about what the market has in store. We know the market will go up and the market will go down, sometimes on the same day. There will be short term volatility regarding the election, impeachment, trade wars, and potential military actions.

There will always be short-term bumps and noise on the road of long-term investing.

While this could cause some bumps in the road ahead, unemployment remains low, inflation remains under control, and wages are making modest increases. All of these bode well for stock prices.

2019 is a prime example of successful investing for investors that tuned out the noise of politics and warnings of the imminent end of the longest bull market in history. Ironically, a year ago everyone was talking about the possible looming recession. The concern now is that no one is talking about it. After more than a decade of economic growth, we will continue to keep our eye on underlying fundamentals and corporate earnings.

LOW UNEMPLOYMENT AND RISING WAGES

What impact does this have on the economy?

December unemployment hit a 50-year low of 3.5%, with employers trying to fill vacant jobs at all skill levels. Although wages have remained stagnate for the past decade, there has finally been some improvement in 2019. This is particularly true for the lowest-paid workers, mostly due to the mandate of rising minimum wages in many states and cities.

This is good news for the economy, since lower-income earners tend to have higher marginal spending, but increased wages could eventually cut into corporate profits.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

NEW BENCHMARKS ON QUARTERLY REPORTS

Effective with the enclosed statement for Q4 2019, we have enhanced our reporting with a blended benchmark to more accurately reflect the makeup of the underlying portfolio and to measure the portfolio’s performance. The previous benchmark used the S&P 500 for stocks and the Barclays Aggregate Bond Index for bonds. The new benchmark includes proxies for additional asset classes of mid cap, small cap, and international stocks, and for short term bonds.

Stock Benchmark

60% S&P 500 Index

12% Russell Mid Cap Index

10% Russell 2000 Small Cap Index

18% MSCI EAFE (Europe, Australia, Far East) International Index

Bond Benchmark

70% Barclays Aggregate Bond Index

30% Barclays U.S. Government/Credit 1-3 Year Index

Stock Benchmark

If your asset allocation target is 50% stocks and 50% bonds, your benchmark will be made up of:

30% S&P 500

6% Russell Mid Cap

5% Russell 2000

9% MSCI EAFE

35% Barclays Aggregate Bond

15% Barclays U.S. Government/Credit

What this means for your portfolio

There will typically be a small difference between the benchmark and our performance since we report our performance net of fees. The indexes do not have fees since investments cannot be made directly in an index.

If you wish to discuss the new benchmark, your portfolio allocation, or any other concerns, please call us. As always, we appreciate your trust and confidence.

Warmest regards,

Platt Wealth Management