SNAPSHOT

S&P 500 up 20.5% in Q2. The index is now down just 3.1% for the first half of the year.

All major domestic stock indices experienced double-digit growth in Q2, whether they be large, mid, small, value, blend or growth.

10 of 11 sectors in the S&P 500 were up 12% or more in Q2, with three of them up more than 30%.

International markets up 14.2% in Q2, but still down 12.6% for the year.

Bonds up 2.9% in Q1 and 6.1% through the first six months of 2020.

SECOND-HALF PROGNOSIS

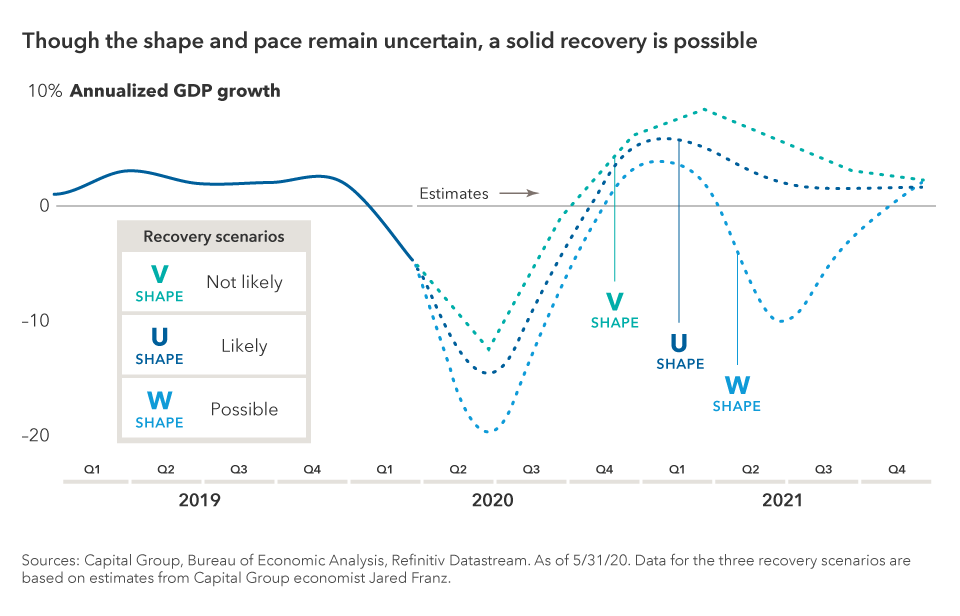

What will be the shape of the economic recovery?

Will it be an initial such as U, V, or W? Or might it be a symbol such as the Nike swoosh or a square root or a reverse square root? Multiple factors will be determinative:

Unemployment – how high can it get and for how long?

- Consumer spending – when do the pocketbooks re-open?

- Corporate profits – dependent on consumer spending.

- State & local budgets – revenues to decline, but by how much and for how long?

THE BEARS

Lockdowns are re-implemented due to increased virus cases, stifling any chance for economic growth. Second waves occur in areas that re-opened too soon and in areas were social distancing was not practiced and the need for masks was not deemed essential. Schools, both primary and secondary, will be forced to close after attempting to open in late summer and early fall, as do most colleges and universities.

Small businesses are not able to re-open and permanently close. Stocks may or may not test their March lows, but they may decrease by 20% to 25% from their mid-year rebound.

THE MODERATES

We adapt to this “new normal.” The new normal is multiple and ever-changing new normals. Restrictions necessitated by the virus constrains economic growth. However, an accommodative Fed and government stimulus packages allow for some growth. The government extends unemployment benefits set to expire at the end of July.

The markets remain choppy as different sectors and companies respond and while most are hurt, some temporarily and some permanently, others adapt and benefit by the then current “new normal.” A vaccine appears on the horizon, if not yet developed. New therapy treatments improve the outlook for many who suffer from the virus.

THE BULLS

Herd immunity against COVID-19 slows the spread. A vaccine is discovered and

becomes available by the end of the year or the first half of 2021. Unemployment

numbers fall and consumer spending improves and corporate profits rebound. The

new normal becomes a memory and the old normal returns.

We believe the moderates win out, but hope for the bulls’ scenario to come to fruition,

while allowing for the possibility that the bears are right.

The Fed maintains interest rates at or near zero, allowing companies to borrow at

attractive rates to weather the economic storm. The unprecedented purchase of fixed income securities by the Fed backstops a panic in the credit markets.

We are here for you.

If you wish to discuss your portfolio or any other financial matters, please contact us. We can also discuss tax and planning opportunities like Roth conversions and refinancing debt that may be attractive now.

We can schedule a phone call or a virtual meeting via GoToMeeting that many of you have already discovered how easy it is to use. Knowing that you are still

on track to reach your goals can give you peace of mind.

Warmest regards,

Platt Wealth Management