2023 1st Quarter Investment Management

Happy New Year!

The S&P 500 Index up by 7.5%.

Russel 1000 Growth was up 14.4 %

5 Year government securities are yielding 3.57%

1 Year treasuries are yielding 4.59%

The annual inflation rate in

the U.S. slowed to 5.4% and the unemployment rate remains at 3.5%.

Gains Soothe Recession Worries

We have now experienced two consecutive quarters of healthy market gains, and the long-predicted recession has not materialized despite the Fed continuing to raise interest rates. The S&P 500 index was up 7.5% in Q1. There was quite a style divergence, however, as the Russell 1000 Growth index was up 14.4% and the Russell 1000 Value index managed a gain of just over 1%. Meanwhile, the small cap index, the Russell 2000, posted a gain of just over 2.7%.

Foreign markets moved in lock-step with the U.S. The broad-based MSCI EAFE international index gained 7.7% in Q1. Emerging markets, as represented by the EAFE EM index, gained just over 3.5%.

Bonds: An Inverted Yield Curve

Bond rates rose dramatically last year, but that trend has moderated. The 30-year U.S. government bond yield is down from 3.96% at the end of last year to 3.65% currently, with the 10-year yielding 3.47%. Interestingly, 5-year government securities are yielding a higher 3.57% and 2-year Treasuries are yielding 4.03%, with 1-year issues yielding 4.59%. When short term rates are higher than longer term rates, particularly the 2-year compared to the 10-year note, this is called a yield curve inversion. An inverted yield curve is often a harbinger of a recession, as all modern-day recessions have been preceded by an inverted yield curve. However, not all inverted yield curves have led to recessions.

The Fed’s High Wire Act

For nearly the past 1.5 years the fed has raised rates nine times with a tenth increase expected this week to 5%-5.25%. This monetary policy tightening is the fastest in four decades, and the futures market is predicting that another increase is coming, too. The Fed is doing a high-wire act balancing its efforts to control inflation without disrupting the US economy. More economists are predicting a recession for the second half of this year.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

Of course, the recession of 2023 was previously predicted for 2021 and then pushed back to 2022. As it is often said, “An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”

The Fed recently released a report examining the failure of Silicon Valley Bank (SVB). In the report the Fed announced its mea culpa for the collapse of the bank citing its own lax oversight along with loosening regulations and poor management by SVB. While its candor is rare and much appreciated, it does not raise our confidence that it can orchestrate its projected soft landing. This is especially true as the Fed has prioritized fighting inflation at the expense of the economy.

The Economy Moves Forward

Even after all the rate hikes, the economy moves forward, albeit at a slower pace. GDP growth went from 2.6% in Q4 2022 to 1.1% in Q1 2023. Yet, unemployment remains at 3.5%, a number that does not assist in cooling the economy and bringing down the rate of inflation. Yes, inflation has slowed somewhat, from a peak of 9.1% to 5.4% over the past year, but it’s still well above the 2% target rate of the Fed. Increased rates and higher borrowing costs will slow the economy, eventually getting inflation down to the Feds target. It’s just taking longer than the Fed wants.

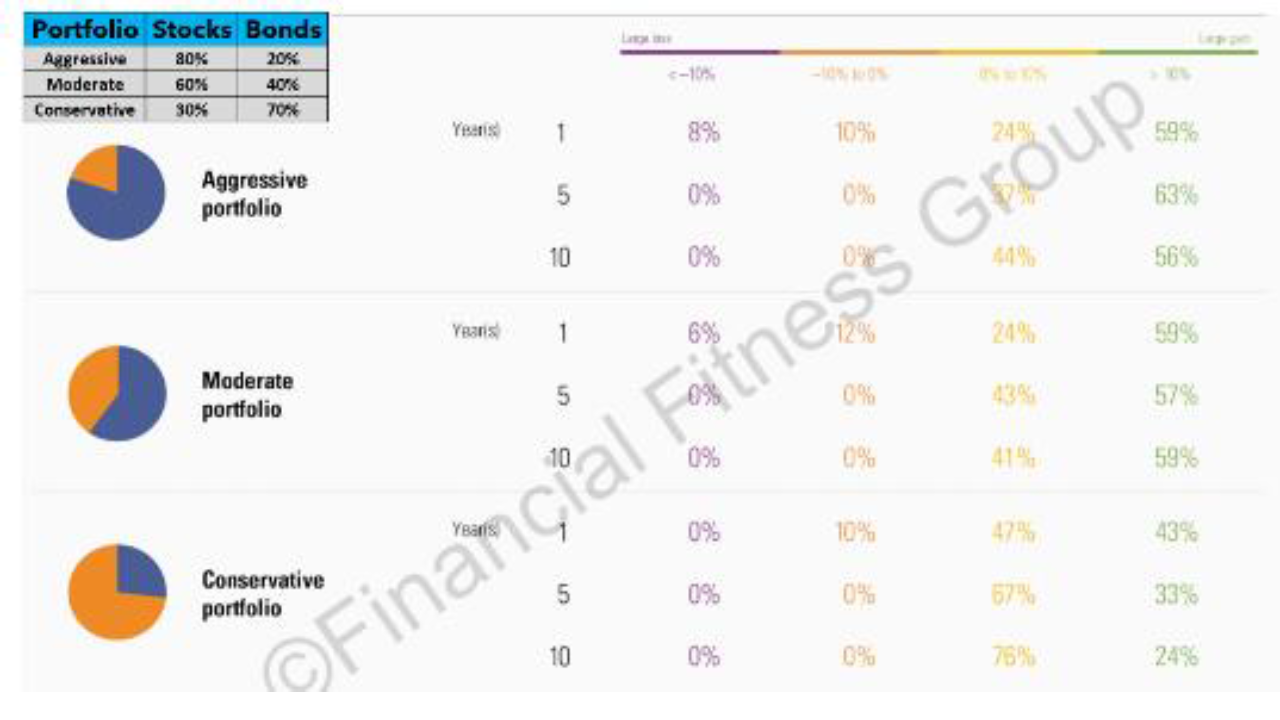

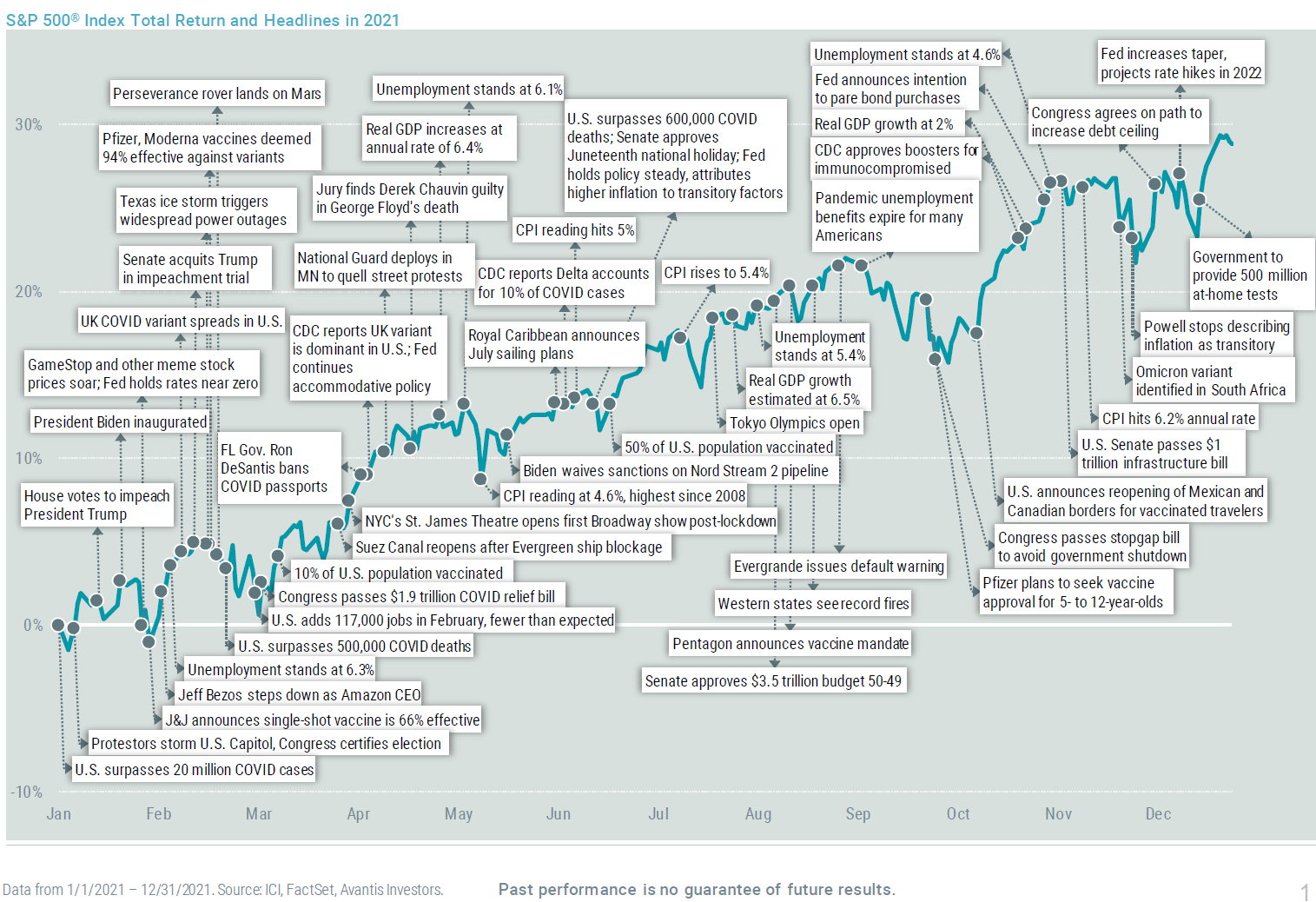

The future is always unknown, and the view ahead is unusually cloudy. Even so, the past two quarters may contain a hidden lesson. Taking actions based on market forecasts and recession predictions, particularly jumping in and out of markets, would have caused an investor to miss two quarters of healthy returns. Long-term investors who build and maintain portfolio asset allocations appropriate for their time horizon and risk tolerance come out ahead in the long-run.

WE ARE HERE FOR YOU

The New Year provides many great opportunities to get a financial plan in place or reevaluate your risk profile. The Platt Wealth Management team is here for you to discuss any changes or new milestones in your life. We are always available to assist you with any financial matters and we look forward to continue to serve you along your financial journey.

Warmest regards,

Platt Wealth Management