U.S SNAPSHOT

The Fed lowered interest rates twice in March due to the coronavirus economic impact.

Unemployment claims jumped to 21.7 million in four weeks.

CARES Act passed, a $2 trillion stimulus package to help individuals and businesses.

Bonds up 3.15% in Q1.

S&P 500 down just under 20%.

MOST COMMONLY ASKED QUESTION LAST QUARTER

What should I do?

We’ve all heard the phrase, “Don’t just stand there. Do something!” John Bogle, founder of Vanguard, modified this for long-term investors to say, “Don’t do something. Just stand there!” In today’s investment environment, both expressions are true.

Most of us are at home following quarantine guidance to slow the spread of this virus and keep healthy. We have learned to use video technology to communicate for work and pleasure. This has given us the opportunity to spend more time with loved ones, catch up on binge watching or reading, or share the occasional video or humorous email. On the negative side, it has allowed us to follow news and financial outlets more often and more intently, which is probably not good for our mental health. We are bombarded with stories about the markets, which can make us think that we must do something. This leads to emotional decisions, and emotional decisions are usually wrong decisions. If you have a well-planned long-term strategy and understand the risks associated with your portfolio, now is not the time to abandon that plan. Now is the time to, “Don’t do something. Just stand there!”

What are we doing? The declines in the markets give us two opportunities which can produce better after-tax portfolio performance.

Rebalancing

We have been rebalancing portfolios to the range specified in your Investment Policy Statement (IPS). Under this disciplined approach, we buy assets that have gone down in value and sell those that have gone up in value. This will enable your portfolio to fully participate in the eventual rebound in the markets.

Tax Loss Harvesting

We have also been harvesting tax losses in taxable accounts. Tax loss harvesting is selling investments which have declined in value and “harvesting” or realizing the loss for tax purposes. The position is then replaced with a similar one so your overall asset allocation is maintained. The losses have value since they can be used to offset capital gains and up to $3,000 of ordinary income. Losses can also be carried forward to offset future capital gains.

It’s Not Timing the Market That Works in the Long Run – It’s Your time in the Market

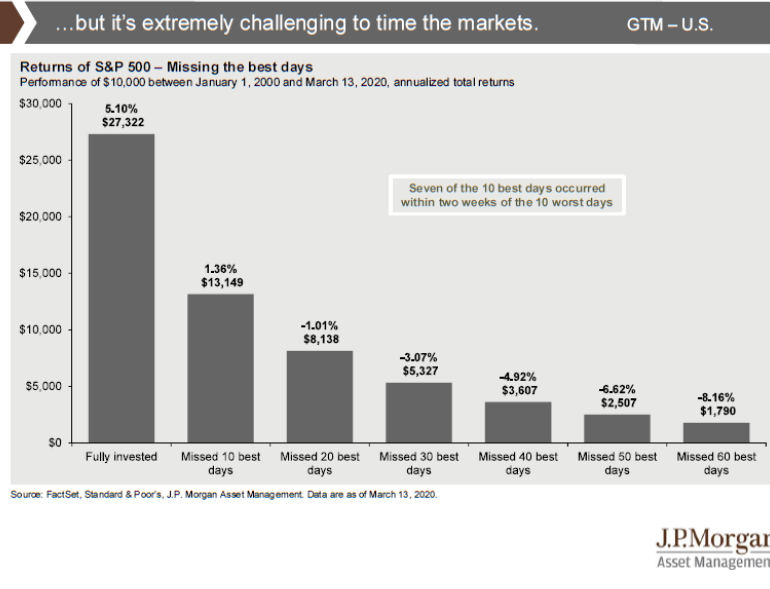

As market volatility increases, it can be tempting to ‘get out of the market until all of this is over.’ You may avoid some down days, but you also miss the up days. The chart below shows the effect of missing the best days of the market.

During the period shown, the S&P 500 index returned 5.10% annualized. If you missed the best 10 days (out of about 2,500 trading days), the annual return fell to 1.36%. If you missed the 20 best days, your returns were negative! Note that during this period, 7 of the 10 best days occurred within 2 weeks of the 10 worst days.

LOW UNEMPLOYMENT AND RISING WAGES

What impact does this have on the economy?

December unemployment hit a 50-year low of 3.5%, with employers trying to fill vacant jobs at all skill levels. Although wages have remained stagnate for the past decade, there has finally been some improvement in 2019. This is particularly true for the lowest-paid workers, mostly due to the mandate of rising minimum wages in many states and cities.

This is good news for the economy, since lower-income earners tend to have higher marginal spending, but increased wages could eventually cut into corporate profits.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

We are here for you.

If you wish to discuss your portfolio or other financial matters, please contact us. We can also discuss tax and planning opportunities like Roth conversions and refinancing debt that may be attractive now. Knowing that you are still on track to reach your goals can give you peace of mind during this time.

Be smart, stay safe.

Warmest regards,

Platt Wealth Management