Staying Invested During Volatile Markets

Economic Analysis by Jeff Platt and Kai Kramer

You may have been watching the news and wondering about the recent market turbulence. We see several main factors affecting markets at this time:

-

- Unemployment rate increased from 4.1% to 4.3% in July

- Jobs growth totals 114,000 in July, coming in lower than the expected 175,000

- Jobless claims for the week ending July 27 climbed by 14,000 to 249,000

Additionally, the Bank of Japan raised their interest rates last week from 0% – 0.1% to 0.25%. The rise in interest rates has caused the yen to appreciate versus the dollar, which is putting an end to a common strategy called a “carry trade.” This is where investors borrow in a cheap currency to buy other (higher yielding) global assets.

So what are we doing about the market drop?

We have all heard the phrase, “Don’t just stand there; do something!” John Bogle, founder of Vanguard, modified this for long-term investors to say, “Don’t do something; just stand there!” In today’s investment environment, both expressions are true. This may sound familiar to many of you as it is exactly what we wrote in our quarterly newsletter of April 2020 when we saw a similar market drop at the beginning of the COVID-19 pandemic.

You might also remember how we stayed the course through that turbulent time by maintaining equity positions, rebalancing portfolios to long-term strategic asset allocation (IPS), and doing some tax loss harvesting. These responsive moves benefited portfolios.

We believe that the recent movement in the markets may be another opportunity for investors with a long-term perspective.

Strategically, we will continue to maintain each client’s asset allocation because even if we were 100% convinced a recession was coming and we sold out of equities, we would still need to decide when to reenter the market and we DO NOT want to miss that window.

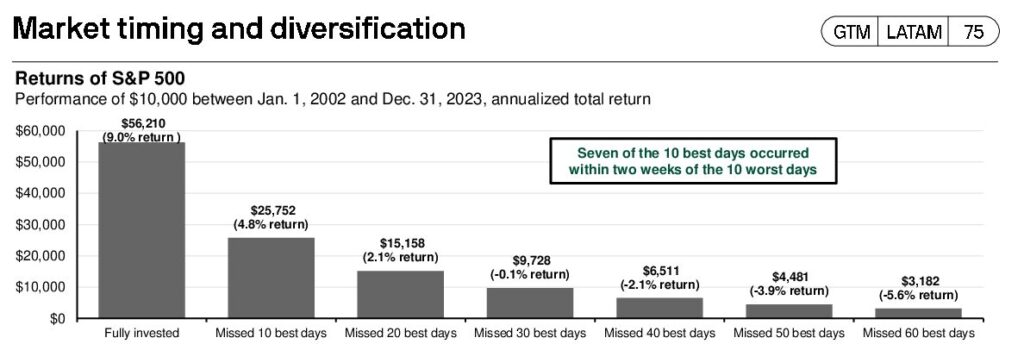

The graph below shows how annualized returns would diminish by missing the 10, 20, 30, 40, 50, and 60 best trading days of the 21-year period between 2002-2023. During that time, the S&P 500 would have returned 9.0% annualized. If you missed just the best 10 days, the annual return fell to 4.8%. If you missed the best 30 days, your returns would be negative! This illustrates the difficulty of trying to time the market and how detrimental this could be to one’s portfolio.

Maintaining portfolio allocations is more difficult when markets experience this type of volatility. Over time, however, investors are compensated for their stock market exposure. Remember, too, that the proper asset allocation is the one you will not abandon during difficult times.

We hope this information provides you with some peace of mind at this time. If you have any questions about what you are seeing in the news or about your portfolio, please do not hesitate to get in touch.

Are you on track for retirement?

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is a critical part of your journey to the retirement of your dreams. An experienced Financial Advisor can help you navigate the complexities of investment management. Talk to a Financial Advisor>

Dream. Plan. Do.

Platt Wealth Management offers financial plans to answer your important financial questions. Where are you? Where do you want to be? How can you get there? Our four-step financial planning process is designed to be a road map to get you where you want to go while providing flexibility to adapt to changes along the route. We offer stand alone plans or full wealth management plans that include our investment management services. Give us a call today to set up a complimentary review. 619-255-9554.