2025 1st Quarter Investment Management

Celebrating Our Team

We’re thrilled to announce two impressive achievements within our team this quarter! These achievements represent exciting new chapters in their professional journeys. We are fortunate to have them on our team.

Congratulations to Kim on her well-deserved promotion to Senior Client Service Associate—her dedication to our clients and exceptional operational skills have made her an invaluable member of our team.

Congratulations to Kai for passing Level 1 of the CFA exam. This significant milestone demonstrates his commitment to professional development and advancing his expertise in asset valuation and portfolio management.

Major US Stock Indexes

The S&P 500 began 2025 on strong footing until tariffs were imposed in February, with the index closing the quarter well off its February highs, along with declines in other major indexes.

-

- The S&P 500 declined by -4.27%.

- The Nasdaq 100 fell by -8.07%.

- The Dow Jones Industrial Average decreased by -0.87%.

Labor Market and Payrolls

The US economy added 228K jobs in March 2025, well above a downwardly revised 117K in February. This beat forecasts of 135K for March and it is the strongest figure in three months.

The unemployment rate changed little at 4.2 percent. It remains to be seen what changes will occur with the recent Federal firings brought about by Elon Musk and the Department of Government Efficiency.

Inflation

CPI readings flashed mixed data in Q1. Consumer inflation climbed from December through February and then fell in March. The yearly CPI inflation rate was 2.8% in March, coming down from 3.0% in February. The Fed’s target inflation goal on an annual basis is 2.0%. As we have indicated often in the past, getting to 3% or slightly lower would be relatively easy for the Fed. The difficulty continues to be getting to 2.5% and then to 2%. Inflation remains stickier, which makes it more difficult for the Fed to lower rates. This is even more pronounced today as tariffs are inflationary in the long term.

The Fed and Rate Cut Possibilities

The overnight lending rate set by the Fed remained unchanged during the first three months of 2025. The Federal Reserve minutes revealed concerns about potential tariff impacts on inflation, leading to a cautious stance on rate cuts. Fed Chairman Jerome Powell repeated his concern the first week of April,

“We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation. While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.”

Powell’s comments, come just days after the Trump administration unveiled the largest escalation in US tariffs. These are even steeper than the tariffs deployed under the Smoot-Hawley Act of 1930. Most economists concur that those tariffs, while not responsible for the Great Depression, certainly exacerbated it.

Recession

At the beginning of the year JPMorgan projected the chances of a recession in 2025 to be about 20%. The potential of tariffs slowing both US and worldwide economic growth, along with increasing the likelihood of inflation, they now put the chances of a recession at 60%.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

Smoot Hartley, passed in 1930 shortly after the market crash of 1929, raised tariffs on a wide range of imported goods. While the act aimed to protect American industries from foreign competition, other countries retaliated with their own tariffs on American goods. This further restricted international trade, and these trade wars further strained international trade relations, which added to economic and political instability at that time.

While history does not repeat itself, it often rhymes. Hopefully, calmer, well thought out approaches to tariffs will lower the chances of a recession. We may have already seen examples of this as Washington now has paused for 90 days on many of the Liberation Day tariffs, apart from those on China.

Your Portfolio

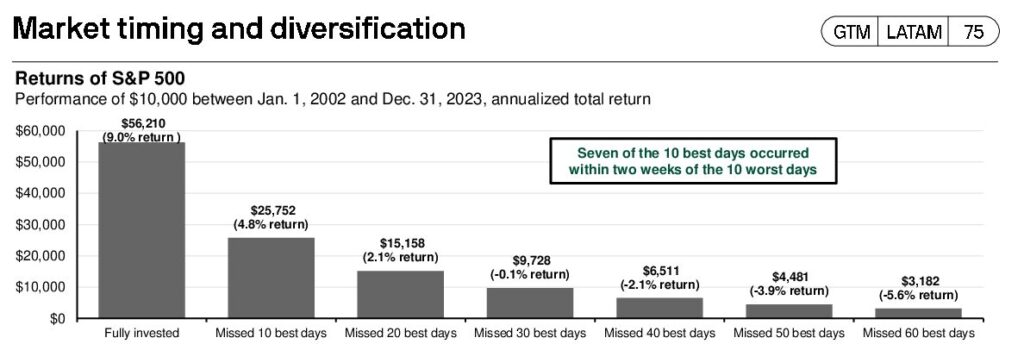

Diversification has always been a key component in the construction of client portfolios. We certainly saw this in Q1. While the S&P 500 fell 4.3%, the MSCI EAFE international index was up 6.9% in Q1. Meanwhile, bonds held up well in the quarter, returning 2.8%.

It has been an eventful and uncertain quarter in the financial markets. We have been here before. OK, not exactly here, but close enough. Markets absorb events and changes, such as the pandemic, economic contraction, and inflation spikes. This, too, shall pass. Remember we are always here for you. If you have questions or concerns, please do not hesitate to reach out.