2022 2nd Quarter Review

ALL STARS UNVEILED

The S&P 500 fell over 16% in

Q2. For the first 6-months of

2022 the index is down 20%.

International equities, as

measured by the MSCI EAFE,

fell 15.4% in Q2 and 20.3% in

the first half of 2022.

Bonds dropped 4.7% in Q2

and over 10% for Q1 & Q2.

The consumer-price index

rose by 9.1% over the past

12-months.

The U.S. economy added 390,000 new jobs in May, the 17th straight monthly gain. The unemployment rate was 3.6% at the end of the quarter.

THE PAST IS PROLOGUE

The bear has arrived with the S&P 500 declining 16.5% in Q2 and falling 20% through the first six months of 2022. The usual solace provided by the bond market was absent as the Bloomberg Aggregate Bond Index fell 4.7% in Q2 and just over 10% for the first two quarters of the year.

This was only the second time in the past 40 years that both stocks and bonds declined for consecutive quarters. The last time there was such an occurrence was during the Great Recession in 2008. Before that, it was 1981.

Concerns over inflation (up 9.1% the past 12 months) and interest rates (the Fed has raised rates three times this year), and their resulting effect on corporate earnings dominated the first half of 2022 and will continue to do so for the remainder of the year.

THE FED

An often-cited trigger for falling stock prices is Fed policy. Fed Chair Jerome Powell has publicly stated that his biggest concern is bringing down inflation, and the Fed’s policy tool is to aggressively raise the fed funds rate. A higher fed funds rate drives up short-term interest rates, which in turn reduces liquidity in the economy, depressing corporate investment and consumer borrowing. With inflation outpacing wage increases, consumer confidence fell for the 2nd consecutive month.

This is certain to dampen consumer spending, which accounts for nearly 70% of US GDP.

All of this is a reversal of a long-term trend where Fed policies provided a fairly strong wind at the back of the investment markets. Bond rates are going up and liquidity is going down, the reverse of the conditions that began with the economic bailout

of the Great Recession and accelerated with the stimulus packages following the Covid outbreak. In essence, the Fed is ‘taking away the punchbowl,’ which had been the impetus for low-interest rates and economic growth. The economy is now moving from a low-yield, low-inflation environment to one of higher inflation and higher interest rates.

BONDS: YIELD CURVES & RECESSIONS

In the bond market, we are experiencing a significant rise in yields at the short end of the curve, but yield rises on longer bonds have slowed down a bit. While still not getting a yield above the current inflation rate, short-term CDs and treasuries are affording returns not seen in years. Meanwhile, the 2/10 yield curve has inverted with two-year treasuries yielding more than 10-year treasuries. Yes, since the 1950s, all recessions have been preceded by an inverted yield curve.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

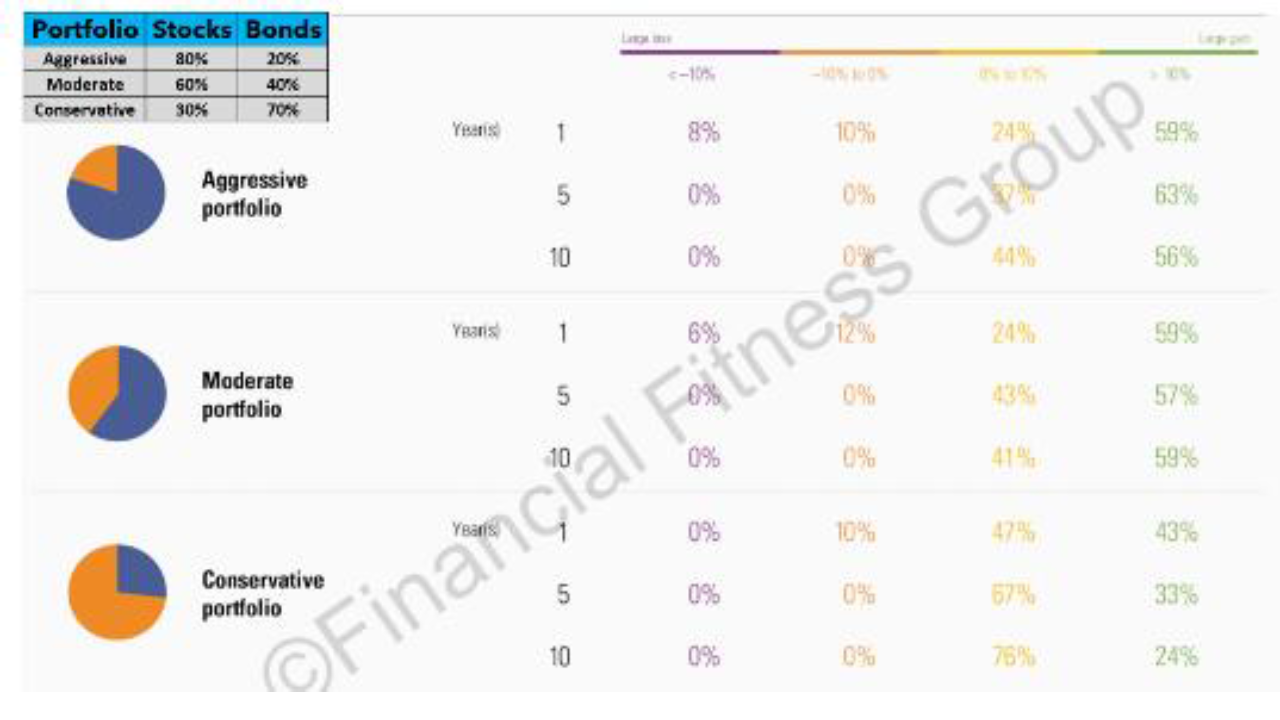

WHAT IT MEANS FOR PORTFOLIOS

On the equity side, we continue to re-balance and tax-loss harvest. When doing so we are adding to large-cap value and small-cap value and decreasing large growth positions. For fixed income portfolio allocations, we continue to reduce the durations and average maturities and re-allocate to short-term CDs and Treasuries.

WE ARE HERE FOR YOU

The Platt Wealth Management team is here for you to discuss any changes to your financial situation or investment objectives. We are always available to assist you with any financial matters of concern to you and look forward to continuing to serve as your partner along your financial journey.

Warmest regards,

Platt Wealth Management