Q3 AND PADRES HAD A GREAT SEASON

The FANGs have driven up the technology dominated Nasdaq 24% YTD.

The Fed will now allow inflation to run above 2% to adjust for previous periods of low inflation.

The 7.9% unemployment figure is down significantly since the near 15% in April.

Home sales rose 10.5% year-to-year in August, with new home sales at a blistering 43% year-to-year.

THE MARKET

The 3rd quarter continued a remarkable turnaround for the stock market. The S&P 500 and Nasdaq Composite indexes reached record highs in Q3, up 8.5% and 11%, respectively. The Nasdaq has now risen 45% over the past six months, its largest two-quarter gain since 2000. The Dow Jones Industrial Average trailed the other indexes but was still up a respectable 7.6% in Q3.

Year-to-date the S&P 500 is up 4.1%, and the Dow is down 2.4%. This year’s darlings, the FANGs (Facebook, Apple, Netflix, and Google), have driven the Nasdaq up 24%. Yet days after reaching its all-time high, the Nasdaq fell into correction territory dropping more than 10% in only three days.

This just meant large value did not lose as much as large growth. The Russell 1000 Value Index was down 2.6% while the Russell 1000 Growth Index fell 4.8%. For 2020 that same Growth Index was up 23% and the Value Index fell 13%. However, this chart “ Value vs. Growth Relative Valuations” suggests that Value is cheap and Growth is expensive. Graph: J.P. Morgan

THE FED

The Federal Open Market Committee (FOMC) approved a change in how it sets interest rates assuring a prolonged period of low rates. The Fed will now allow inflation to run above 2% to adjust for previous periods of low inflation. The current fed funds target rate is 0.00%-0.25% and anticipated to be maintained for the rest of the year and throughout 2021.

UNEMPLOYMENT AND THE ECONOMY

The unemployment rate fell to 7.9% in September, down from 8.4% the previous month. Americans gained 11.4 million jobs back after losing 22 million jobs in March and April. However, recent layoffs announced by corporations, particularly in the airline industry and Disney, do not bode well for a V-shaped recovery. While the unemployment figure is down significantly since the near 15% in April, it may be understated as many people have quit looking for work and are not counted as part of the labor force.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

Portfolio Investment Themes

With rates well below historical norms, we do not think it is the time to increase maturities and fixed income durations. The additional yield does not warrant the additional risk. We continue to move up the credit ladder with both individual issues and bond funds.

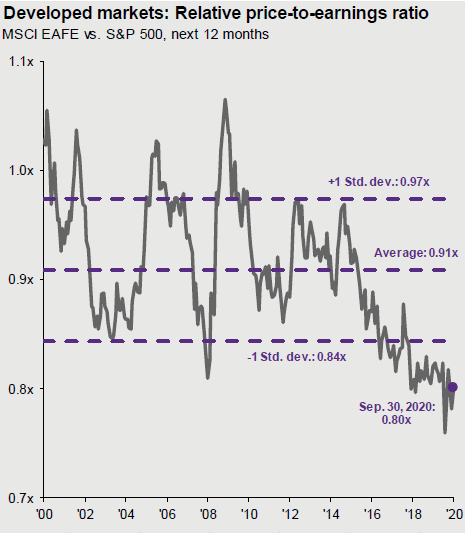

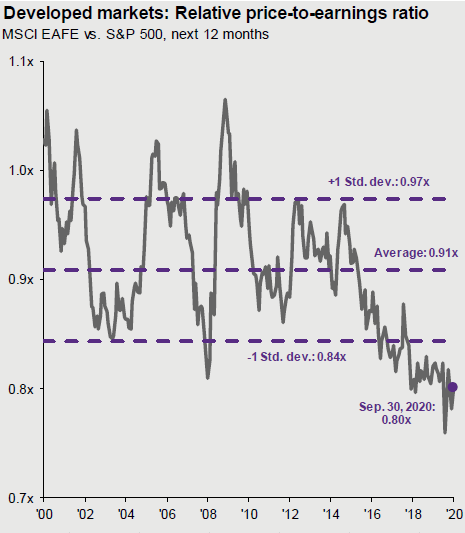

While we have been underweight international equities, they are becoming more attractive from both absolute and relative valuation measures, along with their relative growth prospects. The adjacent chart “Developed Markets: Relative Price-to-Earnings Ratio” depicts that international stocks are the cheapest they’ve been in the past 20 years based on the relative P/E metric. Graph: J.P. Morgan

YOUR PORTFOLIO AND YOUR GOALS

We look forward to meeting with you and taking the time to make sure you’re on-track to achieve your goals. We also want to know if anything has changed recently that could impact your financial future. It’s always a good idea to revisit your asset allocation to make sure you are invested in a portfolio that is right for you. The right asset allocation enables you to stay the course when challenging market environments occur. Let’s also review any short-term cash needs to help maintain the discipline needed for long-term investment success.

Warmest regards,

Platt Wealth Management