Q2 HEAT WAVE

The S&P 500 was up 8.55% in Q2 and 15.25% since January 1st. The tech-heavy Nasdaq 100 was up 11.38% in Q2 and 13.34% since January 1st.

The MSCI EAFE (international index) was up 4.37% for Q2 and 7.33% YTD.

Earnings for companies within the S&P 500 rose 19.7% YTD.

The unemployment rate ticked lower to 5.9%, while wage growth remains steady at 4.6%.

INFLATION

The Consumer Price Index increased 5% through May of 2021 for the previous 12 months. This upsurge so startled investors that the Fed issued a statement stating the increase was “transitory.”

The Fed feels the increase in inflation will be short-lived. Last year the economy was at a standstill, forcing corporations to drop prices on their goods and services. With restrictions easing and “pent-up-demand,” supply is now outpaced by demand, resulting in higher costs. While the increase in inflation is expected to be transitory, the Fed has stated that they will allow inflation to run above 2% to make up for previous periods of low inflation.

ECONOMIC REOPENING

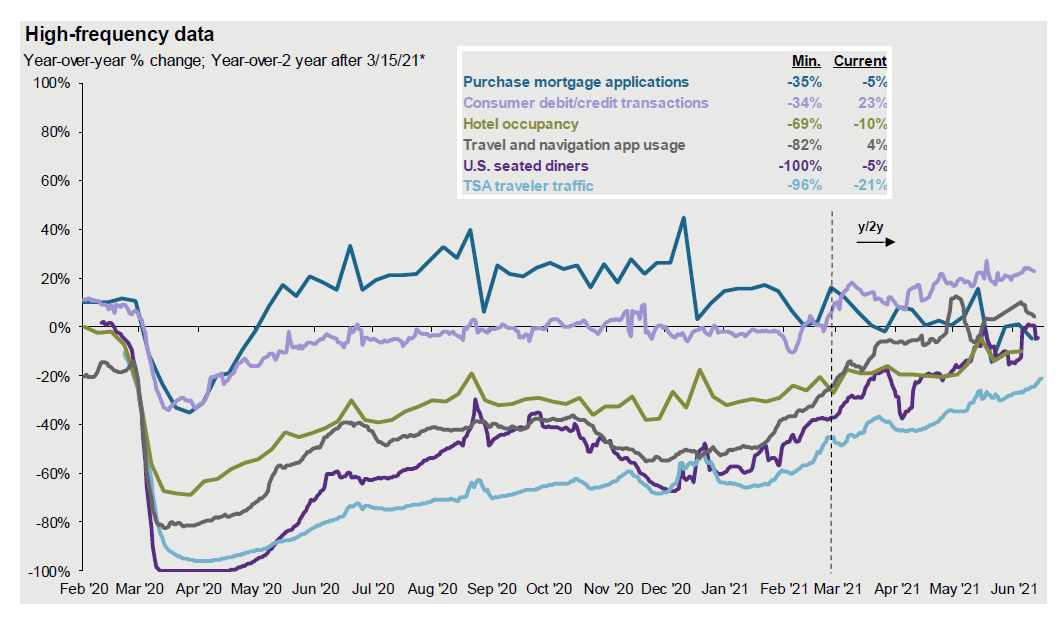

Some of the hardest-hit sectors during the pandemic were restaurants and domestic travel. In Q2 2020, seated diners dropped 100%, and travel declined 96%. Also, the unemployment rate in April of 2020 was 14.8%, the highest level since the Great Depression. With restrictions easing and the deployment of vaccines in full effect, the U.S economy is responding.

Restaurants and travel have exceeded, or are approaching, their pre-pandemic levels. Unemployment is at 5.9%, lower than the 50-year average of 6.3% and substantially lower.

than the levels experienced in Q2 of 2020. Labor demand is at the highest levels since 2000. Consumer confidence and small business owners’ confidence are on the rise, too. Graph by JP Morgan

THE FED

On June 16th, 2021, the U.S Federal Open Market Committee (FOMC) voted to leave the federal funds rate unchanged at 0%-0.25%. This rate has a direct impact on consumer loans and the overall stock market. Also, the Fed will continue to purchase $80 billion of Treasury securities and at least $40 billion of agency mortgage-backed securities per month. These purchases help provide stability to the credit markets.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

INVESTMENT THEMES

We believe the economic environment does not warrant an increase in fixed income maturities and durations. The additional yield on longer-term fixed income securities is not worth the risk at present. We continue to allocate fixed income portfolios to high-quality short and intermediate-term bond funds and individual issues.

For the past 10-years, growth stocks have outperformed their value counterparts. A reversal in this trend occurred in the 1st quarter of 2021, as value outperformed growth. In the second quarter of 2021, growth again was the leader with the Russell 1000 Growth posting returns of 11.93% compared to the Russell 1000 Value with returns of 5.21%. Relative valuation between the two asset classes suggests that value stocks are “cheaper” compared with growth. We continue to balance these two asset classes within our portfolios to offer you further diversification.

YOUR PORTFOLIO AND YOUR GOALS

Your goals, dreams, and aspirations are our priorities. We look forward to meeting with you to discuss any changes to your financial situation. We are here to serve as your partner throughout your financial journey.

Warmest regards,

Platt Wealth Management