MONETARY POLICY AND THE FEDERAL RESERVE

The Fed has remained extremely accommodative in its stance towards the economy, despite the strength of the recovery, inflation pressures, and low unemployment rates. However, recent statements from Chairman Powel indicated that the era of “easy policy” may be coming to an end as unemployment levels tick lower, and the focus shifts to combatting inflation. The Fed’s extraordinary bond purchases are expected to end late Q1 or sometime in Q2. Additionally, it is anticipated that there will be as many as three rate hikes in 2022.

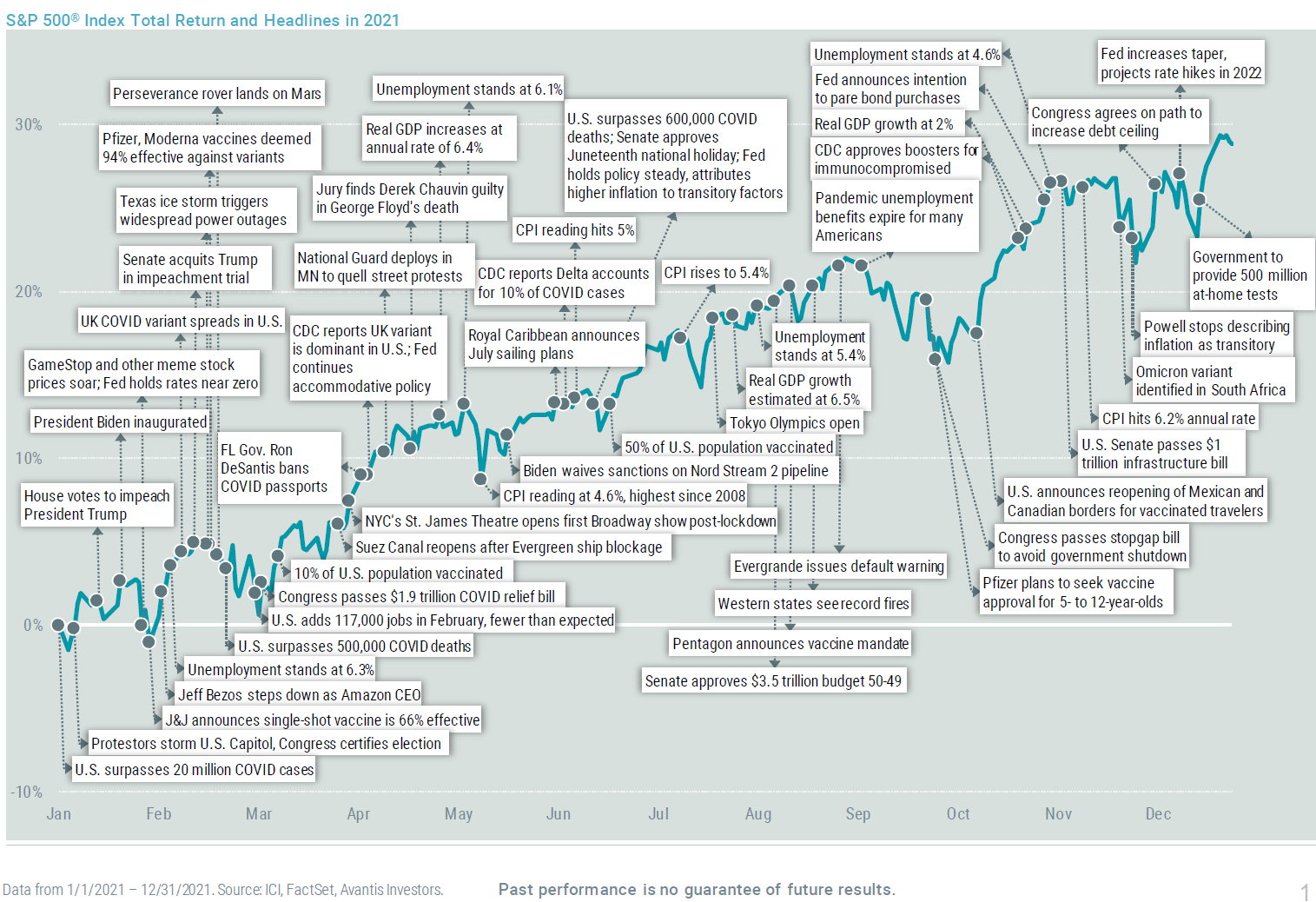

DISCIPLINED OUTLOOK THROUGH THE NOISE

We are cautiously optimistic for 2022. Valuations appear stretched in specific sectors of the market. We still anticipate positive returns for the stock market but less than the double digit returns of the past three calendar years. We will continue our disciplined approach, no matter the noise, to monitor portfolio allocations and to rebalance when necessary, conduct tax-loss harvesting where appropriate, and diversify portfolios to capture return but minimize risk.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

Warmest regards,

Platt Wealth Management