What’s in the American Rescue Plan?

There’s a lot to unpack in the newly-passed, newly-signed American Rescue Plan bill. The goal is to help relieve the economic suffering caused by the COVID pandemic in various sectors. The bill makes unemployment benefits more generous, health insurance more affordable, and having children less expensive. It also reduces the pandemic’s most damaging effects on low-income homeowners and the homeless, people with student loans, state and local governments, and school systems.

Most of the press coverage has focused on the $1,400 checks. Not everybody is receiving them. Only single people with an adjusted gross income of $75,000 or below (households with $150,000 AGI or below) qualify for the full amount. The amount phases out entirely for people with incomes above $80,000 (households with AGIs above $160,000). The reporting period is the most recent year that people filed taxes; it could be 2019 or 2020.

Unemployment and Cobra

The American Rescue Plan also extends unemployment benefits (either through the Pandemic Unemployment Assistance program or the Pandemic Emergency Unemployment Compensation program) for an additional 25 weeks until September 6. It maintains the $300 per week supplemental benefit. It also makes the first $10,200 of those benefits tax-free for people who report less than $150,000 in income. The extra $300 federal supplement doesn’t count when calculating Medicaid eligibility and the Children’s Health Insurance Program.

The healthcare provisions will be a lifesaver for some ex-employees. Under the government provisions in COBRA, people who lost their jobs can continue buying health insurance through their former employer. Still, they pay full-price rather than the subsidized price companies offer to their workers. The new relief bill would have the government pay the entire COBRA premium from April 1 through September 30.

The bill will make health insurance much cheaper for those laid off than those who are still working. (This generous subsidy is not available for persons who left their job voluntarily.) Finally, the law imposes a cost cap on health insurance policies purchased through a government exchange. The premiums should not exceed 8.5% of a person’s adjusted gross income, which will benefit low-wage workers.

How the American Rescue Plan helps families

Families with children will receive additional benefits—but only families whose income qualifies them for the $1,400 checks.

The bill raises the child tax credit from $2,000 to $3,000 ($3,600 for children ages five and under), and it increases the age limit for qualifying children to 17, from 16 previously. These amounts could apply as a tax refund even for people whose tax bill is zero; that is, those who don’t have any reportable income to offset.

Families with incomes between $150,000 and $170,000 would receive the same $2,000 tax benefit as before, and that benefit phases out for married filers with incomes over $400,000 (singles above $200,000).

A bigger set-aside for families with children is a monthly child allowance. The government will send a monthly check of $300 for each child under six years old and $250 for each child between the ages of six and 17.

The American Rescue Plan sets aside $27 billion for financial assistance to people whose household income does not exceed 80% of the area’s median income to offset rent, utilities, and other housing expenses.

The Rescue Plan sets aside $10 billion to help homeowners struggling to make mortgage payments and $5 billion to help the homeless.

Finally, if the Biden Administration decides to cancel student loan debt (which is not a given), the Act specifies that the borrowers wouldn’t have to pay any income taxes on the forgiven debt.

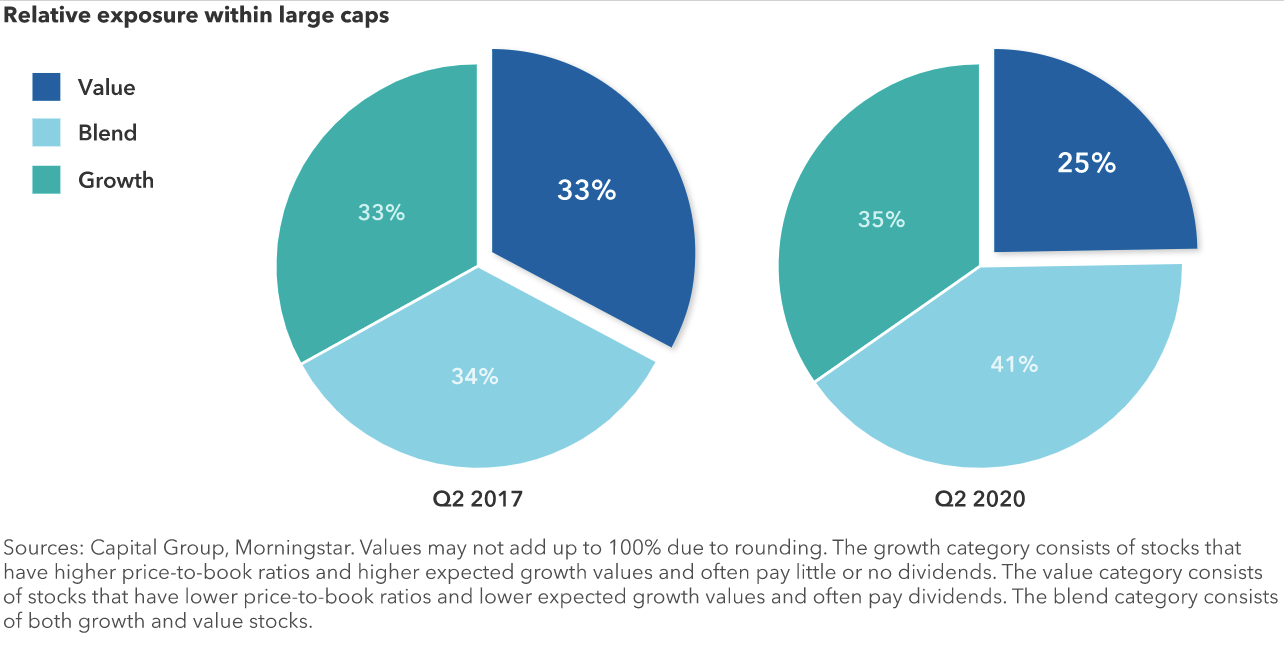

You can see from the chart, with figures compiled by the nonpartisan Congressional Budget Office, that there is also money set aside to keep restaurants and bars afloat and money to help schools better control the risk of infection so they can reopen. $350 billion is going to state and local governments to prevent layoffs and allow them to continue providing essential services

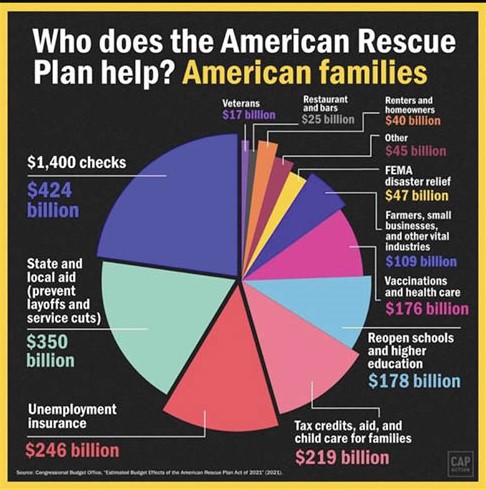

The administration passed the American Rescue Plan as a stimulus measure, but we can better characterize it as disaster relief. A graph prepared by the Congressional Budget Office (shown here) clarifies that the U.S. economy was on a path to never quite recover from the COVID recession before this legislation passed.

With the American Rescue Plan in place, the best estimate is that the economy might fully recover as early as the 4th quarter of this year.

Are you on track for retirement?

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is a critical part of your journey to the retirement of your dreams. An experienced Financial Advisor can help you navigate the complexities of investment management. Talk to a Financial Advisor>

Dream. Plan. Do.

Platt Wealth Management offers financial plans to answer your important financial questions. Where are you? Where do you want to be? How can you get there? Our four-step financial planning process is designed to be a road map to get you where you want to go while providing flexibility to adapt to changes along the route. We offer stand alone plans or full wealth management plans that include our investment management services. Give us a call today to set up a complimentary review. 619-255-9554.