Why You Should Sit on the Board of Directors of a Company

As a member of a Board of Directors, you are responsible at a high level for the activities of the organization, whether it’s a nonprofit or corporation. You’re not concerned with the nitty-gritty details, because the officers of the organization handle those. The mission of the corporate board is to maximize the benefits to the shareholders.

Bylaws of the organization spell out what your specific duties are, but there are some common tasks that most boards share.

Board members act as fiduciaries to the organization. (Just as your independent wealth manager is a fiduciary to your portfolio!) Meaning that they must put the organization before their own personal interests.

At the beginning of the organization’s existence, the board is responsible for its mission. A mission statement is important to develop, so everyone’s rowing in the same direction. Later on, a board may decide to change the mission of the organization, but this should only be done after careful thought.

The board will set the overall policy for the organization, without getting bogged down in the daily minutia. It also oversees the organization’s officers and executives. At the end of the year, the board holds an annual meeting where any changes to mission, bylaws, etc. are announced or any elections held. At a corporation annual meeting, there’s usually the announcement of any dividends being paid.

Organizations like to have certain professions on their board, such as financial advisors, accountants, or lawyers.

Potential liability concern should not be a deterrent when considering a seat on the board of directors.

If you’re concerned about liability, know that board members have a pretty wide latitude when dealing with policies and other oversight duties. Many companies offer officer and director liability insurance. But you can be sued and held personally liable for acts committed while serving, which this type of insurance doesn’t cover.

For nonprofits, the board typically hires the executive director, and may face issues if the director is derelict in their duties. If you’re on the board of a nonprofit, the expectation is that you will fundraise for the mission. This could be your own money, finding outside sponsors or donors, etc. You’ll set policy as a board member, but implementation is left up to the staff.

As a board member you can help direct operations for a cause you believe in.

Most people find that a great way to give back to their community is to join the board of a nonprofit whose mission they believe in and are passionate about. You may find similar satisfaction with a corporate board.

Charitable boards tend to be volunteer positions only, which makes it all the more important to ensure that the mission aligns with your own beliefs and values! Nonprofits, especially the smaller ones in your community, run lean. This provides a greater opportunity for you to be hands-on in shaping the policies and programs of the charity you’ve chosen to work with.

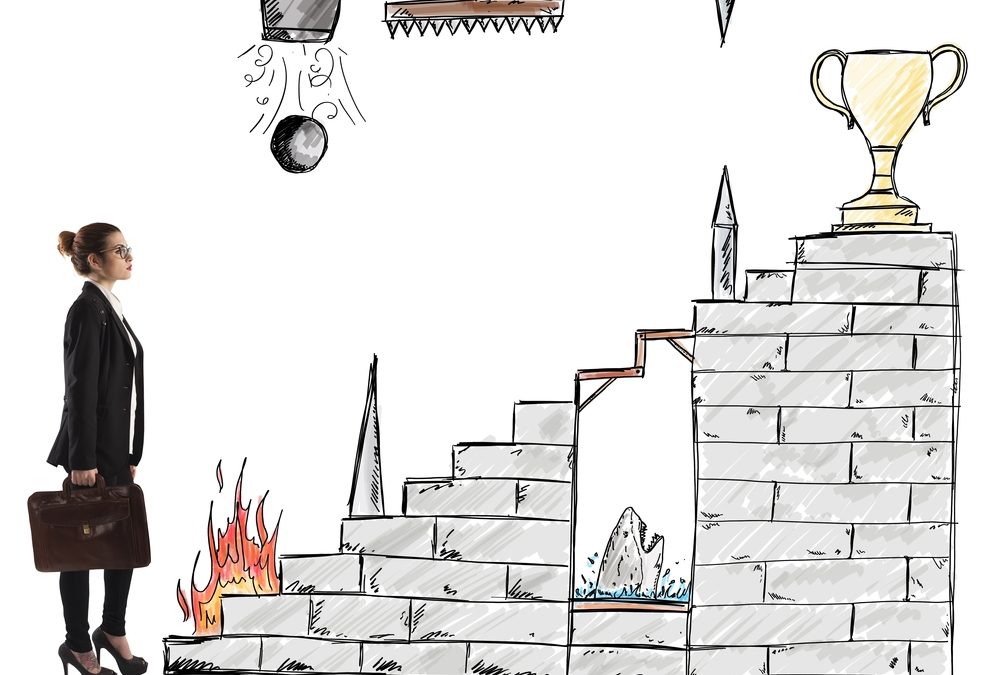

Sitting on the board of directors will strengthen you leadership skills

Being on a board, whether it’s for a company or nonprofit, gives you the chance to experience different leadership styles. Watch how other leaders respond to issues that may be similar to your own. You’ll also likely be exposed to situations you’re not already familiar with.

Working through them with people you may not know as well, outside your own comfort zone, provides an opening to really stretch yourself as a leader. Eventually you may develop very close friendships with the other board members, as a result of spending so much time together solving problems.

You may even have skills you weren’t aware of, that you may be called upon to deploy as you serve. You may also discover some weaknesses that you didn’t know about, and can begin to work on them in order to improve your leadership capabilities. Awareness is half the battle!

Broaden your network with other Board of Directors

Unless you’re joining a group of old friends, you should be meeting some people you might not otherwise have met. A board that’s composed of directors based on the needs of the organization, instead of who knows whom, is an excellent way to expand your network.

When you develop tight friendships with other leaders, it often results each of you getting to know their connections. You end up helping to build each other’s networks.

As you work together, serving the organization, you’ll be able to see the strengths and weaknesses of your fellow board members.

Remember that networking is about building relationships. Meeting with your fellow board members outside scheduled times, can help you better solve problems. Face-to-face meetings are always preferable, but not always possible. Phone calls or online meetings can assist you to fill in the gaps.

Some extra income

As noted above, most of the time you’re going to be volunteering, if you’re sitting on a charity board. By contrast, most companies recognize that the monthly and annual meetings and travel do add up in terms of time and resources. Some of them will provide a stipend for your service.

Especially when you’re facing retirement, serving on a board can keep income coming in as well as keeping your business skills sharp. Which you may not need for business after you retire, but can keep you in good mental shape.

Career perks

You may have heard that people who serve on boards are more likely to be promoted. Anyone trying to get you to sit on their board has probably mentioned that to you! In fact, it’s true.

An article in Harvard Business Review showed that being on a board does provide career perks. In addition to being promoted, those who serve on boards are more likely to be named as CEO and often see an uptick in their annual income.

It’s a seal of approval to be chosen for a board, especially a corporate one. Other executives are demonstrating their belief that you have leadership skills. In fact, large companies groom their execs by having them serve on other boards.

At Platt Wealth Management, we understand the importance of serving on a board of directors. Both our financial planners sit on boards for a variety of different causes and continue to stay involved.

If you’re interested in legacy planning that includes a mission important to you, please call 619.255.9554 or email us to schedule an appointment.