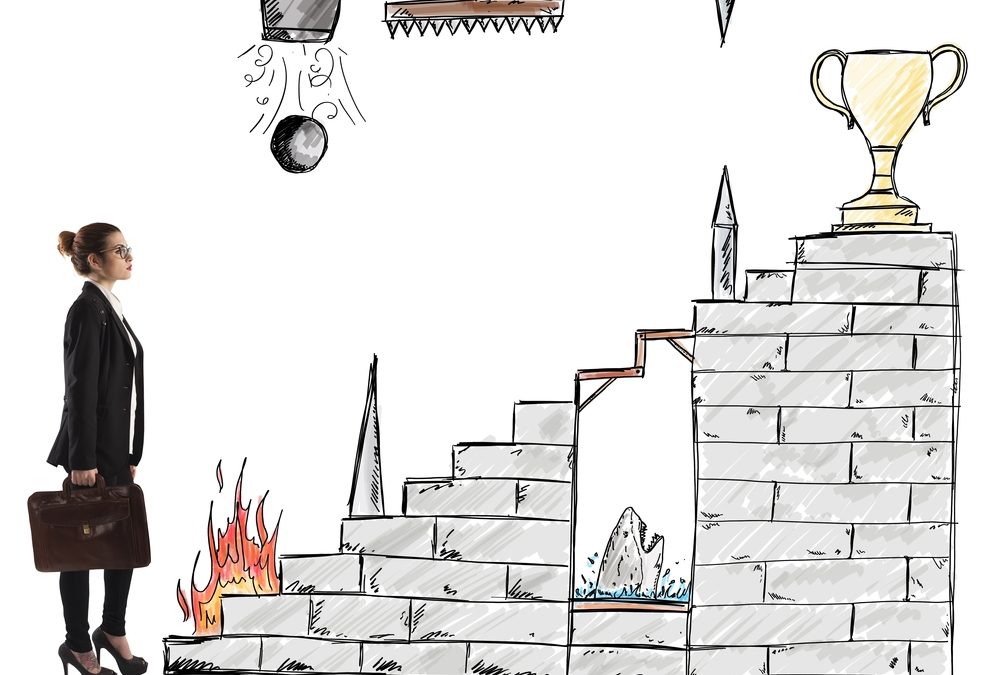

Women experience unique financial obstacles and need custom solutions.

This is the third article in a series on Women Investors.

You’re probably familiar with the studies showing the gender pay gap, that women are paid 10 to 20% less than men for the same jobs. Books like Lean In by Sheryl Sandberg and the research-based Women Don’t Ask by Linda Babcock and Sara Laschever suggest this is because women are much less likely to negotiate job offers and raises, leading to hundreds of thousands of dollars less over their lifetime.

However, recent research was presented in the Harvard Business Review that found women were asking just as often as men, but men were more likely to be successful. There was positive news when the researchers looked at different age groups. Younger women and men in the job market had almost no difference in asking and getting, possibly signaling that negotiating behavior has begun to change.

Culture is shifting too, with the #MeToo movement is just one part of a shift toward fairer treatment for women. Millennials are demanding more equitable and transparent workplaces.

Gender pay gap continues to be a financial obstacle.

Companies are under increasing pressure to report on gender pay disparities. Women are more likely to stay at companies that commit to pay parity, which in turn leads to more women in leadership positions.

Women face other challenges beside the gender pay gap. Women have fewer years in the workforce earning income, with an average of 12 years out of workforce. This is mostly due to maternity leave and caring for family, either children or parents, or both. Taking time off can also face a pay gap due to lost promotions and opportunities as well as decreased salaries from taking a less demanding role. Time out of the workforce can also result in lower Social Security benefits since your benefit is based on a formula using your 35 highest-earning years.

Female employees are less likely to participate in workplace retirement plans, partly due to taking time off. Women are also more likely to work part-time or in jobs that don’t offer retirement plans.

Despite challenges in the workplace and in our own desires to take a different career path, there are things you can do to make sure you are prepared.

Overcome financial obstacles by participating in workplace savings plans.

Start saving as soon as you start working and encourage the women around you to do the same. Participate in your workplace retirement plan. If you aren’t eligible or your employer doesn’t offer one, open an IRA (Individual Retirement Account).

Hone your negotiating skills to overcome financial obstacles.

Prepare for negotiations using these tips from the Harvard Business Review:

Do research and gather salary data to understand your value. Know what you want, and be prepared with some alternatives that are acceptable.

Go into the negotiation with explanations of your achievements and skills that justify a higher salary or other perks. Increase your confidence with practice. Role play with a friend to get more comfortable.

Negotiate communally. Focusing on how what you want helps the team / company (and not just you) can minimize being viewed as too aggressive.

Use multi-issue negations. Negotiating issues one-by-one seems more adversarial, while having multiple issues on the table at once allows you to make trade-offs and been seen as collaborative. Look at the total compensation package since things like more PTO or stock options have monetary value just like your salary.

Be a leader and help others overcome financial obstacles.

Work towards gender parity in your company. Ask your company to do a pay audit and to take steps to correct disparities. Lead parity initiatives if you are in a leadership position.

Plan ahead for common financial obstacles that affect women.

If you want to take some time off, start planning early. Live on the anticipated lower salary before you actually stop working and bank the rest as a cushion. You can still contribute to an IRA even if you don’t have earned income, as long as your spouse has earned income.

Find a financial advisor who understands the financial obstacles women face.

Talk to a financial advisor to come up with a plan that takes your goals and needs into account. Revisit the plan as your circumstances and priorities change.

Would you like to receive more tools, resources and education?

Sign Up

In a couple of weeks we will have a secure portal for you to sign in and view the full Women’s Alliance Round Table presentation, along with questions and answers from coworkers, tools and downloads for your continued financial journey.

Platt Wealth Management offers financial plans to answer your important financial questions. Where are you? Where do you want to be? How can you get there? Our four-step financial planning process is designed to be a road map to get you where you want to go while providing flexibility to adapt to changes along the route. We offer stand alone plans or full wealth management plans that include our investment management services. Give us a call today to set up a complimentary meeting. 619-255-9554.