Q4 FINISHES AHEAD

The S&P 500 and Nasdaq finished the quarter up 12.15% and 15.63%, respectively. For the year, the S&P gained 18.4%. Nasdaq was up 44.92%

Growth outpaced Value for the year with gains of 38.5% and 2.8%, respectively.

Since the market low in March 2020, all major domestic stock indices are up over 60%.

US Treasury yields remain low, with the 10-year rate at .93% and the 30-year rate at 1.65%.

The unemployment rate as of November 2020 was 6.7% compared to 14.7% in April of 2020.

ECONOMIC RECOVERY

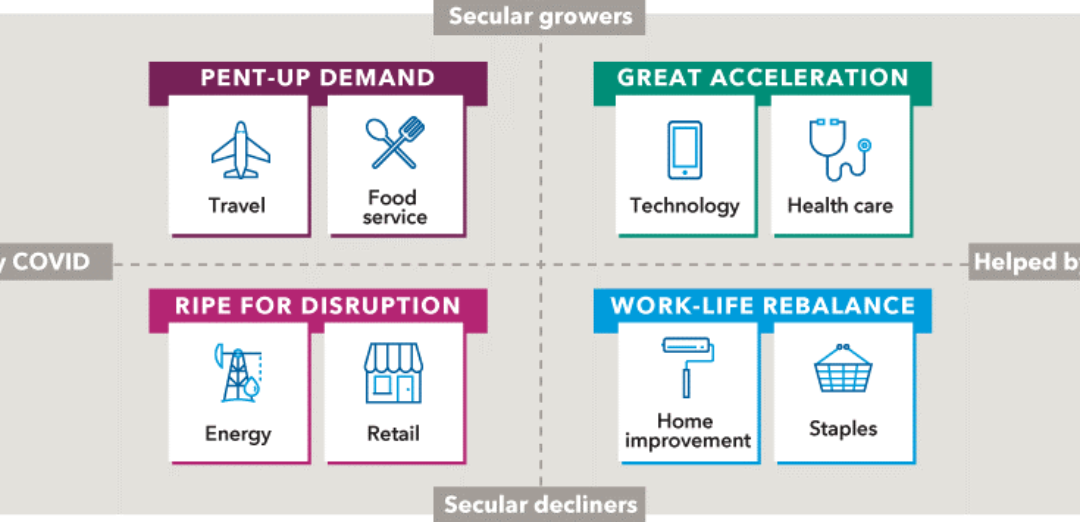

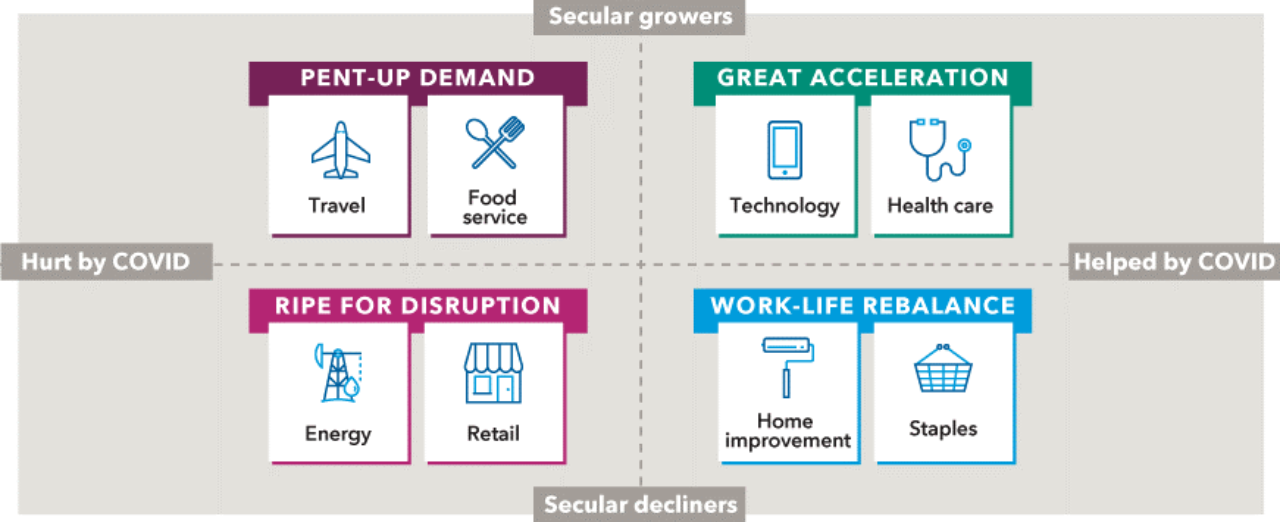

Six months ago we posed the question, “What shape will the economic recovery take? Will it be an initial such as U, V, or W? Or a symbol such as the Nike swoosh?” It is now apparent that we missed a letter, as the recovery has taken on the shape of a K. Sectors of the economy have moved quite differently from one another. Online retail was up 69% in 2020, and information technology was up 44%, with home improvement in 3rd place, up 28%. The losers were energy, airlines, retail REITS and hotels, resorts & cruise lines, down 34%, 31%, 28%, and 26%, respectively.

Cloud computing, e-commerce, video streaming, digital payment processors and home improvement stores benefited from the COVID pandemic. Restaurants, hotels, airlines, retailers and small businesses have been decimated. Yet, there is pent-up demand for many of these industries.

THE FLIGHT TO NOWHERE

On October 10, 2020, a Qantas Airlines flight took off from Sydney, Australia for a seven-hour flight to Sydney, Australia. That’s not a misprint. The non-stop flight took off from Sydney and arrived seven hours later in Sydney. What is even more remarkable is that the flight sold out in 10 minutes. People are yearning to travel once again and will do so as it becomes safer. The recovery will not be as fast as airlines, hotels, cruise ships, restaurants, or theaters would like, but it will happen.

UNEMPLOYMENT

Unemployment was below 4% at the start of the year. By April, it had soared to nearly 15%, its highest level since the depression. At the end of the year, the unemployment rate fell to 6.7%, and the number of unemployed was at 10.7 million. While both measures are much lower than their April highs, they are nearly twice their pre-pandemic levels in February of 3.5% and 5.7 million.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

THE DOLLAR

The dollar fell in 2020 to multi-year lows due to historic low-interest rates, increasing government debt, and a bleak economic outlook. A declining dollar makes international markets and U.S. companies with a strong global presence more attractive. A weaker dollar means increased earnings to U.S. multi-national firms when the global economy rebounds.

MARKETS

The bull market that made its debut in March of 2009 ended in March of 2020. The S&P 500 index recorded its quickest fall from grace with a decline of 34% in one month. A gain of 68% promptly followed by the end of the year, resulting in a return of 18.4% for the index in 2020. As measured by the MSCI All Country World ex-U.S. index, international equities performed slightly worse with a decline of 39% and a rebound of 63%, producing 2020 returns of just over 3%.

2021 OUTLOOK

GDP GROWTH

The International Money Fund (IMF) estimates global GDP will rise by 5.2% in 2021. Emerging markets GDP growth is projected at 6%, with Eurozone at 5.2%, and the United States at 3.1%. These projections bode well for diversified portfolios with international exposure. Vanguard has similar projections for the Eurozone and emerging markets, although slightly greater estimates of 5% for the U.S. They anticipate, however, superior returns from international equities because of their higher dividend yield and lower valuations.

COVID AND VACCINES

Growth estimates are based on the successful rollout of vaccines. Unfortunately, we already see signs that this will take longer than hoped for. It appears infection immunity will be more likely in Q3 or Q4 of 2021.

2020 reminded us that, as we have always said, you cannot time the market. At the end of Q1 most major Wall Street firms were lowering their expectations for the markets. Goldman Sachs slashed their year-end target for the S&P 500 to 3,000 in March. They later raised it to 3,600 in August, then increased it again to 3,700 in November. It finished the year at 3,756.

We have always stressed that the right portfolio asset allocation is the one that you will not abandon during difficult times, and these were certainly difficult times. Headlines foresaw the end of the world. But as many of you have heard me say, “Statistically speaking, the end of the world does not happen that often.”

Knowing that you are still on track to achieve your goals can give you peace of mind during this tumultuous period. If you wish to discuss your portfolio or any other financial matters, please contact us for a phone call or virtual meeting.

Warmest regards,

Platt Wealth Management