It seems like so many of us tend to over complicate things, whether in finances or life or business. As we move through life, we accumulate more, and we get entrenched in routines that no longer serve us. However, keeping things simple is essential at any stage of life.

Having less to keep track of is freeing! In honor of National Simplify Your Life Week, which is celebrated the first week in August, let’s take some steps to simplify our business and finances.

Simplify your business: Do the big rocks first

At this point, you probably automatically prioritize your workday routine. Taking care of the top three priorities that move the needle every day is an effective way to make sure you get the essential things done.

One way to think of it is the “Big Rocks” theory from Stephen Covey. Suppose you have a certain amount of sand and a certain amount of big rocks to put in a bucket. When you fill the bucket first with sand, none of the big rocks will fit in the bucket.

But if you start with the big rocks first, the sand fills in around them. With limited time in the day, it’s important to fill the hours first with the big rocks, which are your top priorities, and allow the smaller tasks to fill in around it.

Simplify your business: The Eisenhower decision matrix

Too bad it’s not possible to know how any company will perform in the future, especially a start-up! All founders and employees of newly launched companies assume that the stock will be more valuable in the future, otherwise they wouldn’t be working there. Your financial planner can talk you through this election, so you can make an informed decision.

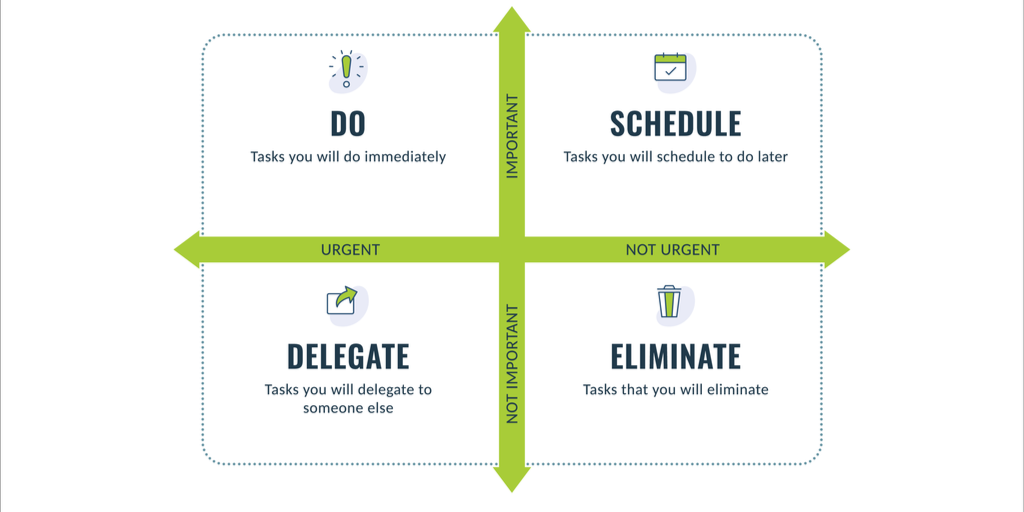

Another way that those in business determine their most important tasks is to consider a 2×2 matrix with one axis being urgent and the other important. You might also know it as the Eisenhower decision matrix after President Dwight D. Eisenhower.

You can sort all your daily tasks into one of the four boxes. Urgent tasks are what you need to do right now, and people typically react to them. Important tasks are the ones that lead to success, and people are responsive to them.

The main problem is that people often tend to confuse urgent for important.

- Not important and not urgent

These tasks should be removed immediately from an executive’s list. Delegate these is you want them done or deleted them completely.

- Not important and urgent

They may demand attention, but ultimately these tasks don’t help achieve any goals and should be delegated or eliminated.

Phone calls and texts often fall into this category. They may be relevant to others, but not to you, and so you should limit your time in this quadrant.

- Urgent and important

Crises and problems fall in here. Perhaps counter intuitively, you should also try not to spend too much time here! Develop solutions that prevent the crisis from happening. Planning and organizing are good ways to reduce the tasks that fall into this quadrant.

- Not urgent and important

Here’s where you want to spend your time. Not reacting to crises, so these tasks are not urgent. However, they help you achieve your goals and mission.

Are you on track for retirement?

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is just one part of your journey to the retirement of your dreams. A Certified Financial PlannerTM can help you navigate the complexities of financial planning. Talk to a Financial Planner>

Simplify Your Finances

Needlessly complicating your financial life usually involves paying more in fees as well. You have even more motivation to streamline here. When index funds solve your need for diversification, there’s no reason to add in other types of investments, for example

Simplify Your Finances: Consolidate

It’s also helpful to consolidate your accounts with one financial advisor where possible. The exception possibly is your 401(k), which typically needs to stay with the management company until you leave the firm.

Your financial planner should be able to view all your accounts so they can properly diversify it. When you split your funds among different advisors, none of them have an overall picture, so you’re not getting the diversification you need.

It also helps to consolidate your traditional (as in, non-Roth) retirement accounts into one. Many investors who have worked at several firms maintain one traditional IRA account. They roll all their 401(k)s into it with no tax consequences when they leave each firm. All their pretax retirement money is in the same pool, making life much easier when it comes time to take required minimum distributions (RMDs) at the age of 72.

The IRS considers all your pretax accounts when calculating RMDs. If you have several traditional retirement accounts and you lose track, you could accidentally underpay your RMD.

Underpayment will result in a 50% penalty on the amount that you should have taken out but didn’t. It is much easier to have everything in one place and receive one notice from the custodian of the amount you need to take out.

Similarly, you can consolidate your checking and savings accounts. Pick the highest interest rate savings account net-of-fees to put all your money in, and the cheapest or no-fee checking account.

You don’t need more than one credit card for your personal life, and probably only one for your business. When there’s no reason to maintain multiple cards and accounts, consolidate down to one.

Simplify Your Finances: Revisit retirement goals

If you haven’t revisited your financial goals in a while, now might be a great time to do it. You may want to adjust your retirement goal and drill down to the goals that need focus. The fewer major goals that you have to focus on, the easier it will be to achieve them.

If you want to talk to us about simplifying your financial life, please give us a call at 619.255.9554 or send us an email. We’d love to hear from you.