Should I be worried about inflation?

Many investors want to know if there are good reasons now to be worried about inflation. Inflation, which is the trend of prices over time to rise, hasn’t reared its ugly head too much so far in the 21st century. In fact, during the coronavirus pandemic, some sectors experienced deflation instead.

However, some Americans still recall the 1970s, with runaway inflation but without a strong economy (stagflation). Inflation has been less of an issue since Congress added monitoring inflation as part of the Federal Reserve’s mission, in addition to “full” employment.

But as you know, past performance is no guarantee of future results!

Why some economists are worried about inflation

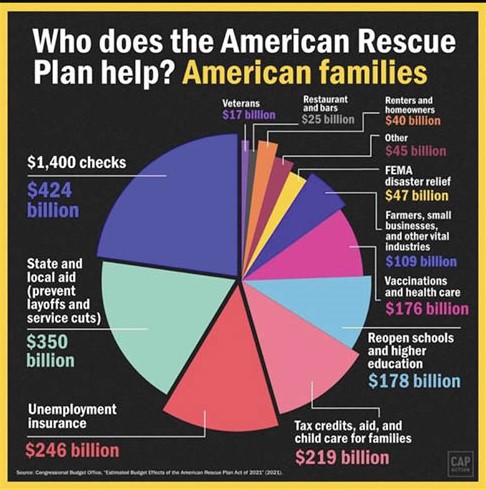

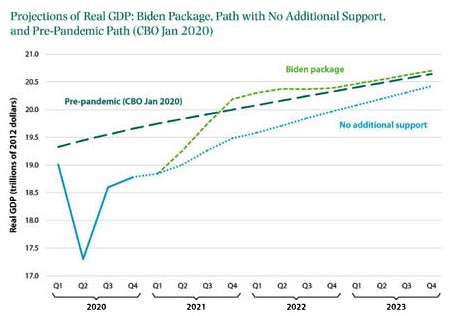

To help Americans return to work after the pandemic and keep small businesses afloat, the current administration passed a stimulus bill. Some, though not all, economists are worried that the effects of the stimulus, plus the expected higher performance of the economy in the near future, in addition to continued “loose” monetary policy designed to encourage demand, could cause prices to soar.

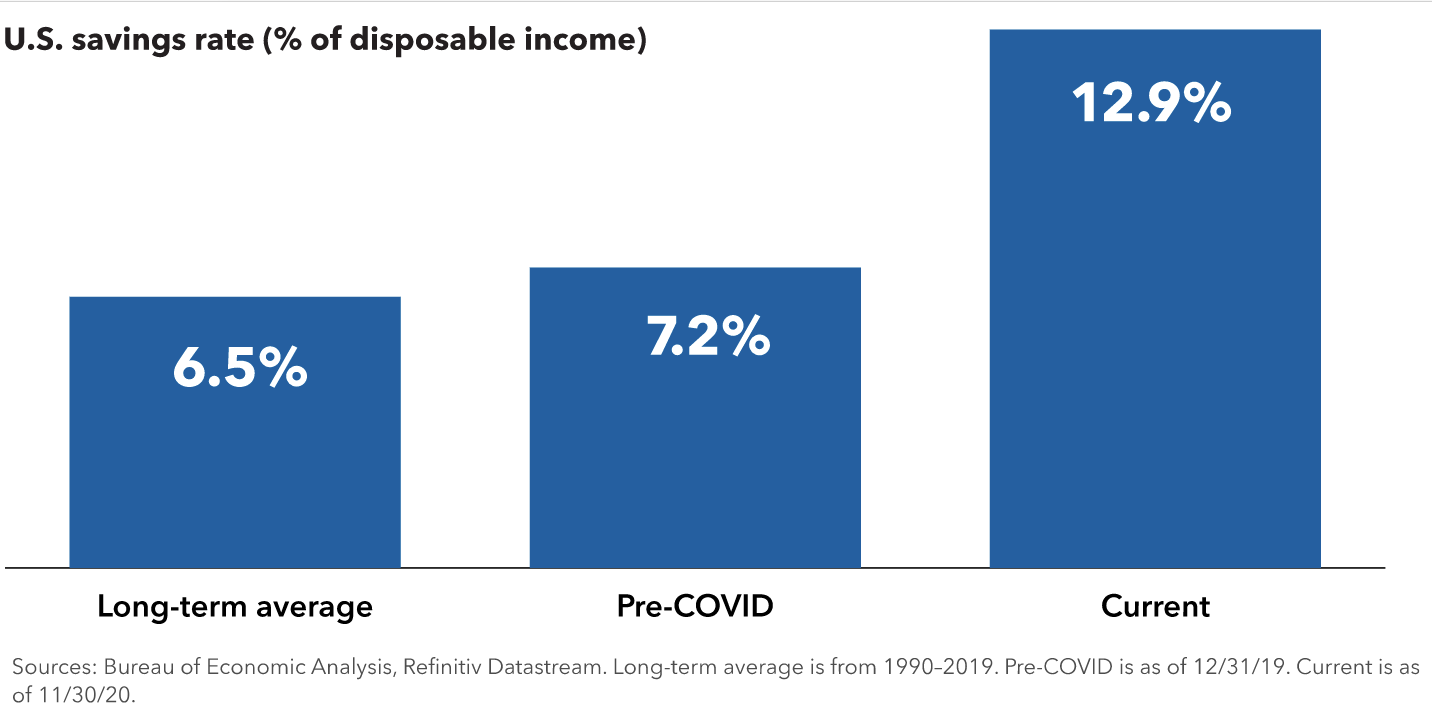

You might recall that inflation is often described as “too many dollars chasing too few goods.” The stimulus plus loose money provides more dollars. Yet it remains to be seen whether there will be too few goods.

Rising prices are one thing and not necessarily a problem in and of themselves. The issue is when paychecks don’t grow along with inflation. When consumer grocery bills are more expensive, but their wages have stayed the same, inflation creates a problem that’s both financial and political.

It may be worth noting that in inflation-adjusted terms, workers have about the same purchasing power on average as they did forty years ago, even though productivity has risen. What wage gains we’ve seen are mostly to employees in the top wage tier, according to Pew Research. If wages don’t match inflation, workers will be relatively poorer than they were in the 1970s.

In addition, bond yields have gone up recently, which is often a sign that investors expect inflation. This attitude is often a self-fulfilling prophecy: because investors are concerned about it, inflation starts to rise.

Inflation isn’t as simple as it may seem

You’re probably familiar with the term permabear, a person constantly prophesying stock market drops and economic recessions. Similarly, there’s a group of economists who frequently warn of impending inflation, who perhaps should be referred to as permainflators.

Inflation is commonly presumed to increase as employment increases, which is how it worked in the 20th century. However, the US hasn’t experienced inflation during the past few unemployment events, including the Great Recession and the coronavirus pandemic.

Although people generally understand what is meant by inflation, measuring it is a bit trickier. Most models use a “basket” of consumables and calculate the price changes on the basket on an ongoing basis.

One of the more well-known measures is the CPI or Consumer Price Index. It has some quirks, including out-of-pocket medical expenses, but no changes in what Medicare is charged (which would increase the bills for seniors on the plan).

Another issue lies with the quality measurement. When telephone providers began offering unlimited data services, CPI dropped due to the assumption that people would get more for their money. But very few people actually saw their phone bills decrease.

The Fed measures things differently by viewing what businesses are selling through the Personal Consumption Expenditure (PCE) index. This calculation captures behavior changes due to price shifts. For example, it will reflect more people buying oranges when apple prices go up. It also takes Medicare into account when looking at health care expenses.

Core inflation is the term used when food and energy are removed from the baskets. Their prices fluctuate with the weather, oil supply, and other factors that aren’t relevant to inflation.

It’s not at all clear why inflation has remained so low this century, even with fluctuations in employment that would typically increase and decrease it. Also, although inflation, in general, remains low, some sectors such as healthcare and housing have experienced significant increases. Before the pandemic, inflation in services was generally higher than inflation for goods.

If inflation has such adverse effects, why are people worried about its opposite, deflation?

Not all inflation is bad. As in medicine, it’s the dose that makes the poison. Note that the Fed’s target is 2% inflation, not zero.

Out-of-control inflation, when wages can’t keep up with rising prices, is problematic. Consumers can’t afford to consume, which means more firms go out of business, employing fewer workers.

On the other hand, a modest amount is an indicator of a good economy. It’s great for homeowners with fixed-rate mortgages, for example. Higher inflation brings with it higher interest rates, which also gives the Fed room to cut rates in a recession.

Decreasing prices may sound good at first, but they’re a signal of a weak economy. Deflation means that debts get more expensive, and that’s bad for nations with a lot of debt. It’s also bad for economies that have workers with a lot of debt too. The US doesn’t need deflation right now.

But what if we turn into Argentina? Or Venezuela? Or the US in the 1970s?

Argentina is a country with hyperinflation run amok. Restaurants write their menu prices on stickers to update as their supply of food becomes more expensive. There’s no point in saving in Argentinian pesos. Hyperinflation is a key driver for many Argentinians to enter the cryptocurrency market, to varying degrees of success. Other victims of runaway inflation include Venezuela today and the US fifty years ago.

Can it happen here, to the US in the 21st century? Technically, yes, it’s possible. However, it’s unlikely. The financial system has changed quite a bit since the 1970s. None of the three countries above had a strong central bank (the Fed) dedicated to managing inflation the way it does today, for one thing.

Long story short for worries about inflation?

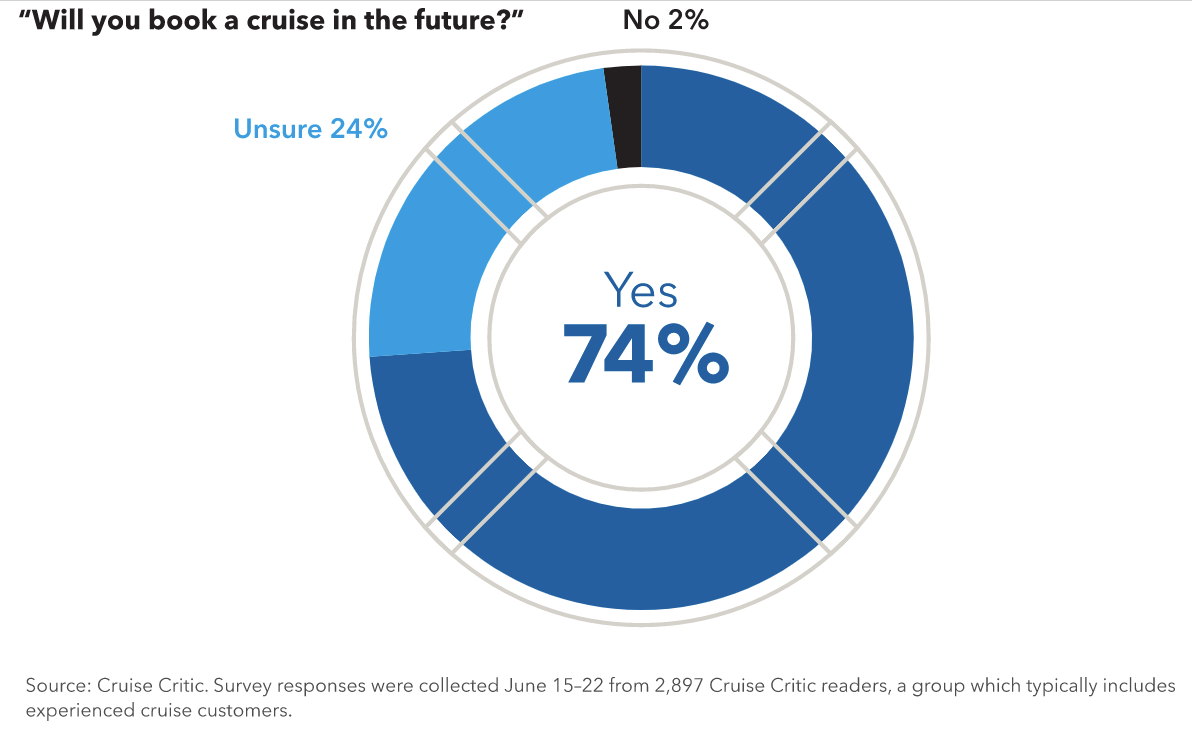

There are both short-term and long-term dynamics in play right now. The pandemic is short-term, and no one knows what will happen when we slowly resume normal activities.

Treasury Secretary Janet Yellen, previously the Federal Reserve chair, has said that employees out of the workforce are a much more significant threat than inflation. That’s why she agrees with spending money on the stimulus.

If inflation starts heating up, today’s Fed has ways to cool it down. Including raising interest rates. Savers would be happy with higher rates since they’d earn more than they currently do.

We can’t say inflation is gone for good. Or that no one needs to worry about inflation at all. But at the same time, it’s unlikely that the US will suddenly be in an Argentina-like situation. Right now, focusing on getting people back to work after the pandemic is a higher priority.

Would you like to discuss how your portfolio will hedge against inflation in the long term? Feel free to give us a call at (619)255-9554 or send us an email to set up an appointment.

Speak to an Advisor

Would you like to discuss how your portfolio will hedge against inflation in the long term? Feel free to give us a call at (619)255-9554 or send us an email to set up an appointment.

Fee Only Fiduciary

Platt Wealth Management is a fee-only advisor helping clients acheive their financial goals. We offer customized financial advice, financial planning and investment management. If you would like to learn more about our services or get in touch for a consultation to review your current portfolio please give us a call. 619.255.9554. We provide stand alone scenario based financial plans for a flat fee, retainer based and assets based investment management or a combination of both for full wealth management services.