How Rising Interest Rates Could Impact Your Finances

As expected, the Federal Reserve is holding firm to its policy of hiking short-term rates in an effort to cool inflationary pressures. Generally, these small, incremental rate increases don’t immediately impact consumers. The fed rate is the rate the Treasury charges banks for the use of money overnight. When the Fed raises its short-term rate, the banks will increase the rate they charge borrowers, so consumers may experience a slight uptick in borrowing costs.

The more significant impact on consumers comes from an increase in long-term rates (Treasury bonds), which have also seen an uptick this year, impacting mortgage rates, variable loan rates, credit card interest, savings account rates, and certificates of deposits.

Here are the ways higher interest rates can impact your finances and some steps to take to mitigate their effect.

Higher Mortgage Rates

After hovering near historic lows for several years, mortgage rates jumped past 5% for the first time in more than a decade. With Treasury bond yields expected to inch higher, mortgage rates won’t be far behind.

Rising interest rates won’t impact you if you currently hold a fixed-rate mortgage. However, if you have plans to refinance your loan, now would be the time to do it because there’s no predicting how high rates could climb.

If you hold an adjustable-rate mortgage, your interest costs will increase, so now may be your best opportunity to lock in a reasonable, fixed rate.

Higher Consumer Debt Costs

Credit cards and other types of consumer loans also carry variable rates, which can be expected to increase with rising interest rates. Keep in mind, variable rates on consumer loans tend to adjust once per year, while credit card rates can change at any time.

Your best bet is often to pay down high interest, variable debt as quickly as possible to avoid swift changes to your payment. Some lenders offer personal loans with fixed rates for loan consolidation as an option to explore. You could also look for 0% balance transfer opportunities, though that would only be a temporary solution.

Good News for Savings Deposits

Savings accounts are already seeing yield increases. However, unlike rates on consumer debt, which lenders are quick to raise when interest rates rise, rate hikes on savings accounts tend to be smaller and less significant. Still, accounts that were recently yielding as low as 0.025% have jumped to as high as 1.0%. While it’s still relatively low, it’s an improvement. If interest rates continue to increase, you can expect yields on your savings to follow suit.

The Impact of Rising Rates on Investments

Bonds

Rising interest rates affect different types of investments in different ways. For example, bonds are almost always negatively impacted by rising interest rates. That’s because rising rates force bond yields up, which decrease bond prices. However, if you hold a bond to maturity, you will receive the entire value when you redeem it. If you sell bonds in this environment, you will likely receive less than their par value. General rule of thumb: When interest rates decrease, bond prices should increase again.

Stocks

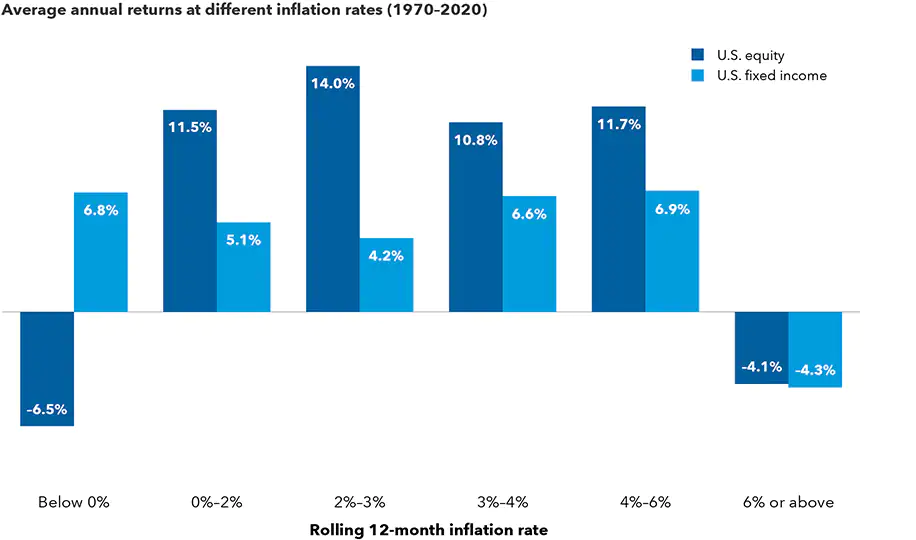

The impact of rising interest rates on stocks can vary depending on the industry or market sector. Stocks of companies with a lot of debt don’t perform as well because they will have higher borrowing costs. Because interest rates are increasing as a result of higher inflation, the bottom line of some companies suffers because of the higher cost of producing or selling goods and services. However, well-established, well-managed companies with big brands, dominant market positions, and low or no debt can perform well in a high-interest and inflationary environment.

Diversification is Key

As always, the key to successful investing in any interest rate environment is to ensure you are well-diversified with a mix of different asset classes. Because it’s difficult to know which asset class will outperform another at any given time, owning assets with low correlation to one another helps to minimize volatility. For example, historically, stocks and bonds have a low correlation, so it is good to have a mixture of both in your portfolio.

Time to Reassess Your Personal Finances

Although many people have never experienced it, rising interest rates are a normal part of the economic cycle. For more than three decades, borrowers have benefited from declining rates (not so much for savers). Now the cycle is turning to where savers will benefit over borrowers.

Keep in mind that economic cycles can last for years or even decades, so it is essential to maintain some flexibility so that you can make adjustments to your finances that can mitigate adverse effects while capitalizing on positive ones.

At Platt Wealth Management, we understand that the rising rate environment is new for many younger investors and may bring up some (not so fond) memories for our older ones. But, rising rates aren’t all bad and simply need to be accounted for in your financial planning.

As always, we are here to answer any questions or address any concerns you might have about this rising rate environment. Our goal is to support you through these ebbs and flows in the economic cycle so you stay honed in on what is most important to you on your financial journey.

Are you on track for retirement?

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is a critical part of your journey to the retirement of your dreams. An experienced Financial Advisor can help you navigate the complexities of investment management. Talk to a Financial Advisor>

Dream. Plan. Do.

Platt Wealth Management offers financial plans to answer your important financial questions. Where are you? Where do you want to be? How can you get there? Our four-step financial planning process is designed to be a road map to get you where you want to go while providing flexibility to adapt to changes along the route. We offer stand alone plans or full wealth management plans that include our investment management services. Give us a call today to set up a complimentary review. 619-255-9554.