How Pent Up Demand Could Fuel Economic Recovery

With major league baseball’s spring training just around the corner, you may already be daydreaming about the smell of cut grass and roasted peanuts, hearing the crack of the bat and the roar of the crowd — just to feel normal again.

If so, you are not alone — not among fellow Americans weary of the COVID pandemic nor within the context of history. This would not be the first time Americans have lived through a period of austerity brought on by a pandemic that resulted in burgeoning pent-up demand and economic recovery. In 1918, the Spanish Flu and World War I largely curtailed social gatherings and other activities across the country.

To be sure, the U.S. was a very different place in the early 20th century, but consider that attendance at baseball stadiums in 1918 was half that of the previous year.

By 1919, however, the pandemic had largely subsided, the war was over and attendance at games soared from 2.8 million in 1918 to 6.5 million in 1919. The decade that followed — the Roaring ‘20s a time of exploding economic recovery— coincided with the first golden age of the automobile. Americans eager to see the countryside bought nearly 26 million cars and 3 million trucks in the 1920s, according to Automotive News.

Could pent-up demand for travel and leisure drive a Roaring ‘20s economic recovery today?

Ready, willing — and able — to spend

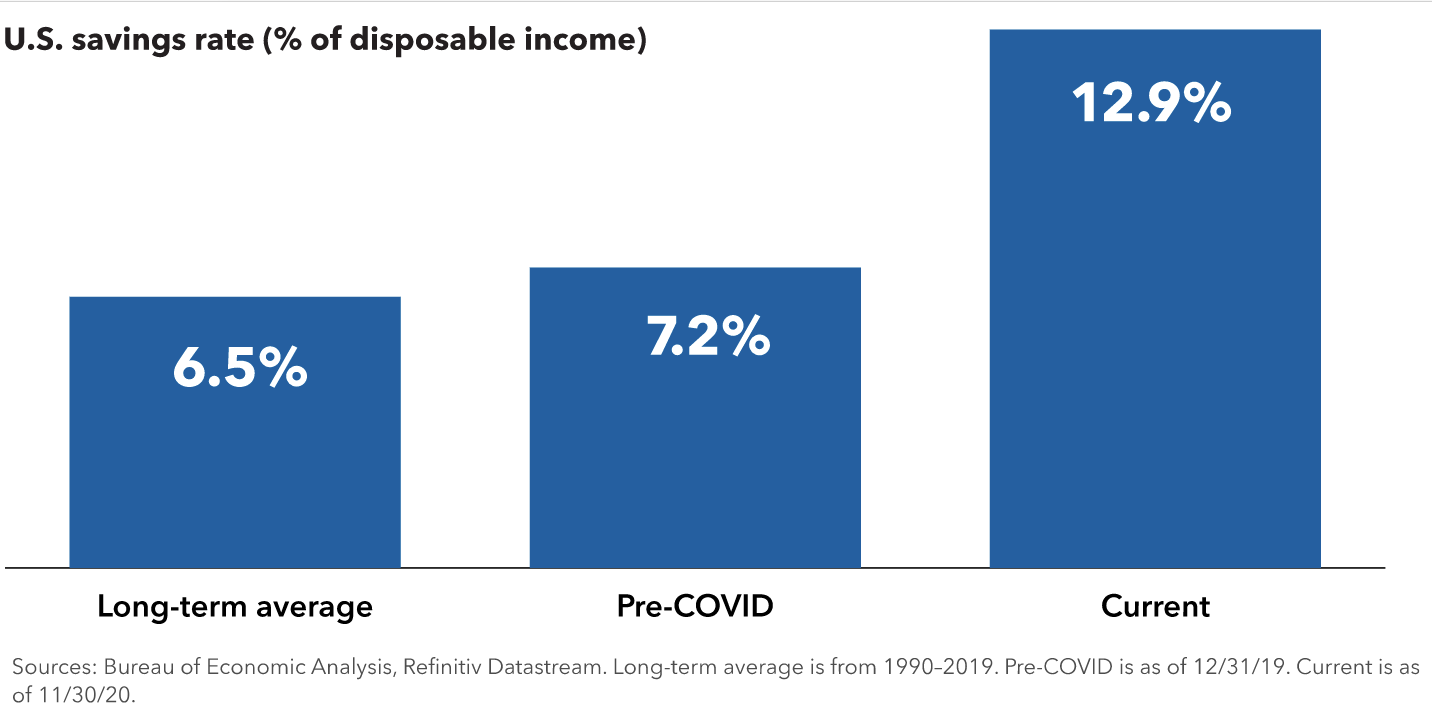

Indeed, cabin fever appears to have taken hold of consumers everywhere. There are signs that Americans are prepared to act: Savings rates have soared since the start of the pandemic, and though they have slowed a bit in recent months they remain relatively high.

Many consumers have boosted their savings during the pandemic

Once the current situation subsides, the desire to travel plus the ability for consumers to spend means we could potentially see a powerful economic recovery.

The economic environment is much different than the global financial crisis of 2008. Today, looser fiscal policy, looser monetary policy, strong banking infrastructure and a higher personal savings rate could drive a sharp pickup in demand.

These conditions not only can benefit the travel and leisure industries but also the broader economy. To be sure, there will probably be hiccups along the way, and some areas will likely recover more quickly than others.

Passenger loyalty: A tailwind for cruise lines toward economic recovery

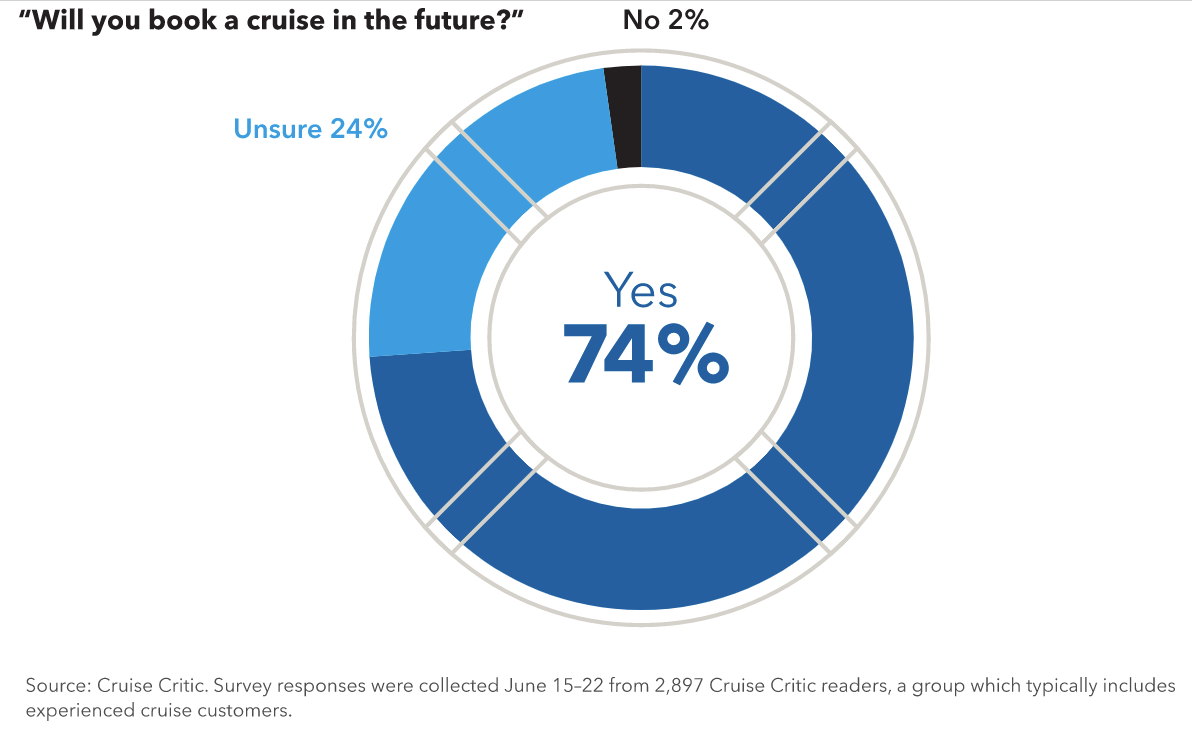

Cruise ships became the epicenter of the COVID crisis in February 2020, when 3,700 people were quarantined aboard the Diamond Princess after a shipboard outbreak. At the time, the ship accounted for half of all known cases outside mainland China.

Over the past year, this industry has gotten so much negative media, yet people are still booking cruises for 2021 and 2022.

In fact, more than 70% of respondents to an industry survey said they will cruise again.

Loyal customers can keep cruise industry afloat

While cruising has resumed in Europe, the U.S. Centers for Disease Control imposed a “no sail” order that has not yet been lifted in North America.

There is still uncertainty as to when ships will set sail again, but there is a possibility that they will be cruising near full capacity quicker than many people expect.

What’s more, with intense focus on healthy sailing practices, there’s a case to be made that they could one day be considered among the cleanest places on earth to vacation.

Vacation plans up in the air

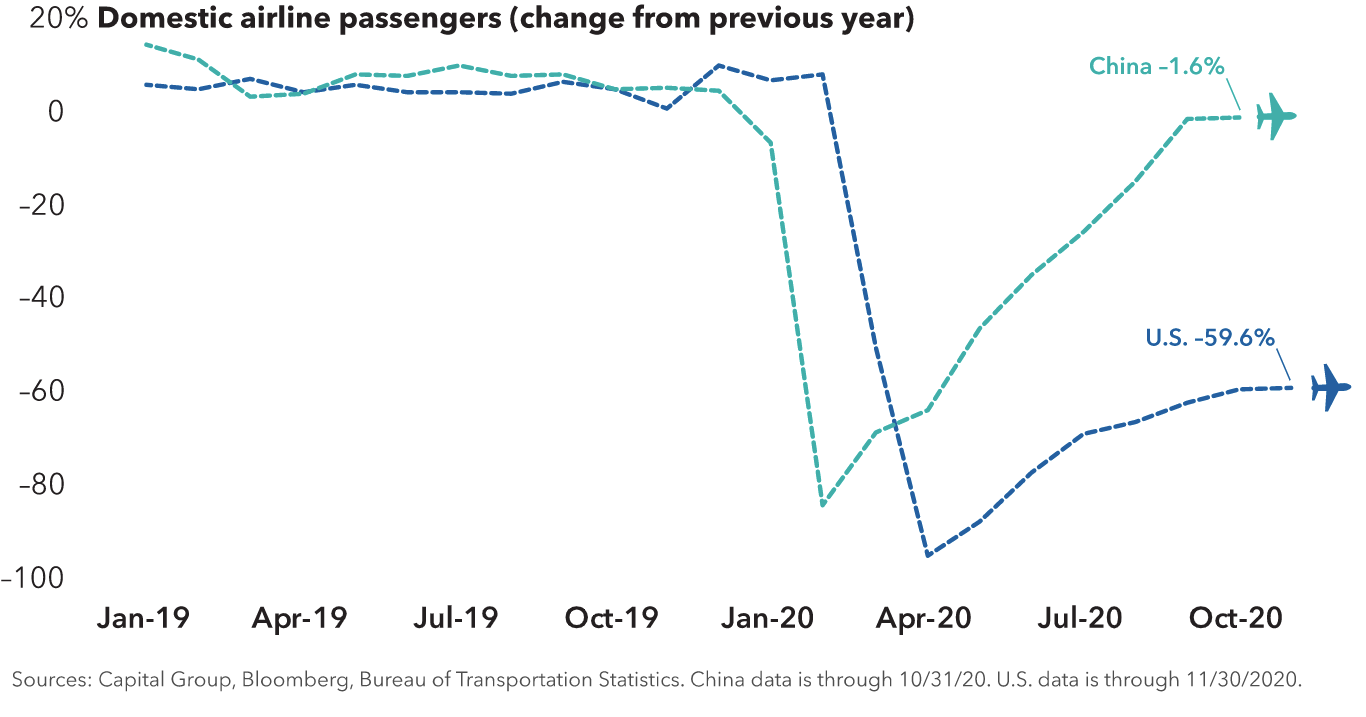

As was the case in the cruise industry, global air travel was down an estimated 66% in 2020, about 20 times worse than the previous record. Within the U.S., which is more dependent on business travel, the devastation was worse: Air travel declined as much as 95% in the early months of the crisis.

The rollout of the vaccines and, prior historical events, leads to increased confidence that demand will bounce back. For example, we also saw this after the September 11 attacks. A lot of people thought consumers would never fly again, and traffic recovered quickly.

Indeed, in China, where the virus is largely under control and the economy has rebounded, domestic air travel has nearly returned to pre-COVID levels.

Air travel in China has soared back. Will the U.S. soon follow with it’s own economic recovery?

The ripple effect for economic recovery waves

A revival in travel demand can also have a powerful ripple effect, creating the need for a range of goods and services and helping drive job growth across a variety of industries. Among these are aircraft manufacturers, jet engine makers, hotels, casinos and restaurants — all of which were devastated by the pandemic.

Consider aircraft engine makers, which operate a recurring revenue business model. Companies like Safran and General Electric build the engines and sell them at a modest profit, but the engines must be serviced regularly, and the engine makers can generate a great deal of revenue from the service contracts.

Unlike other sectors of the economy during COVID, aircraft engine makers are not going to see digital disruption upend their business. After all, there are no digital aircraft engines.

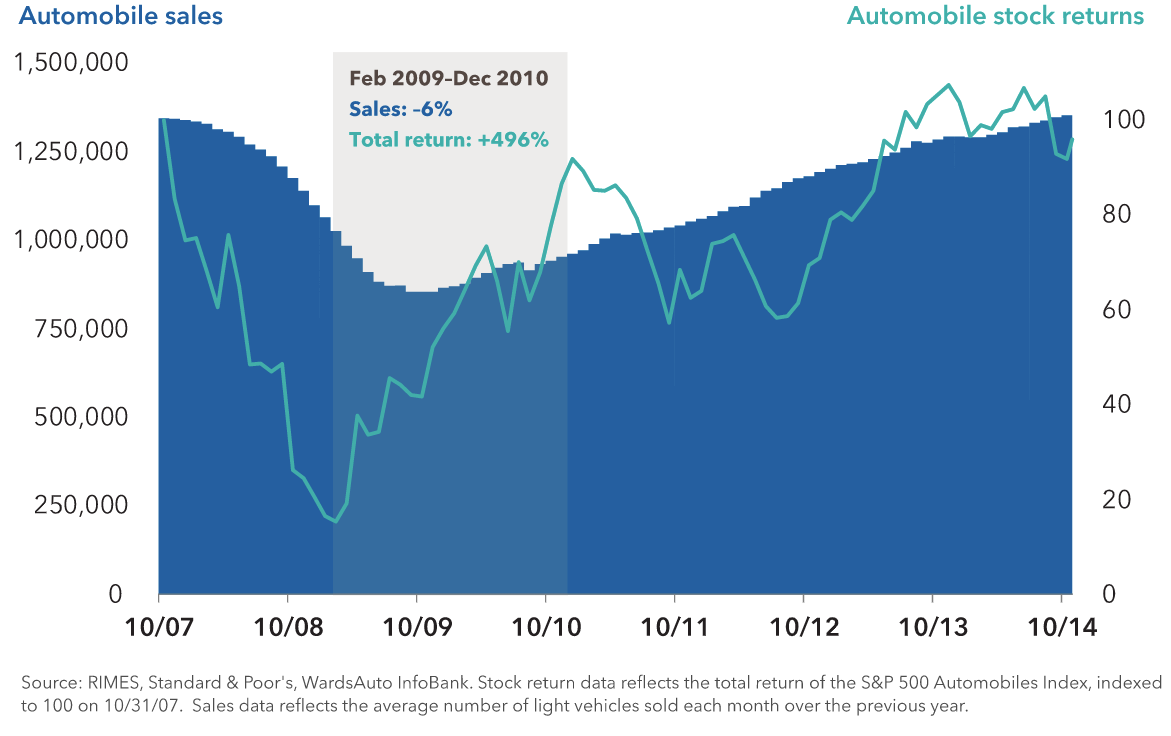

Markets tend to anticipate recoveries

Markets often anticipate recoveries in the underlying economy, so it’s important to recognize underlying trends early. Consider the global financial crisis, a period when the housing and automobile industries were severely beaten down. By 2012 it became clear that demand was building, thanks to changing demographics and an aging auto fleet. In both industries, a full recovery took several more years, but a rebound in auto- and housing-related stocks anticipated the recovery in demand and earnings. From February 2009 through December 2010, auto sales fell 6% while auto stock returns advanced 496%.

Auto stocks rebounded ahead of sales after the global financial crisis

More recently, since the introduction of the vaccines, shares of companies across a number of travel-related industries have registered strong gains.

The market often reflects a recovery in earnings before they materialize. In a year from now, we could be in a very different environment where demand and earnings for some of these companies begin to recover in a more meaningful and sustained way.

Maintaining a balance

Students of history can look to many examples of past crises and declines that were followed by powerful economic recoveries thanks in part to pent-up consumer demand. Examples include the travel sector after 9/11 and the housing and auto industries following the end of the great financial crisis in 2008–2009.

For investors and their advisors, it is important to make sure portfolios are balanced with exposure not only to growth strategies but also to strategies focused on more value-oriented companies, like many of the travel-related stocks.

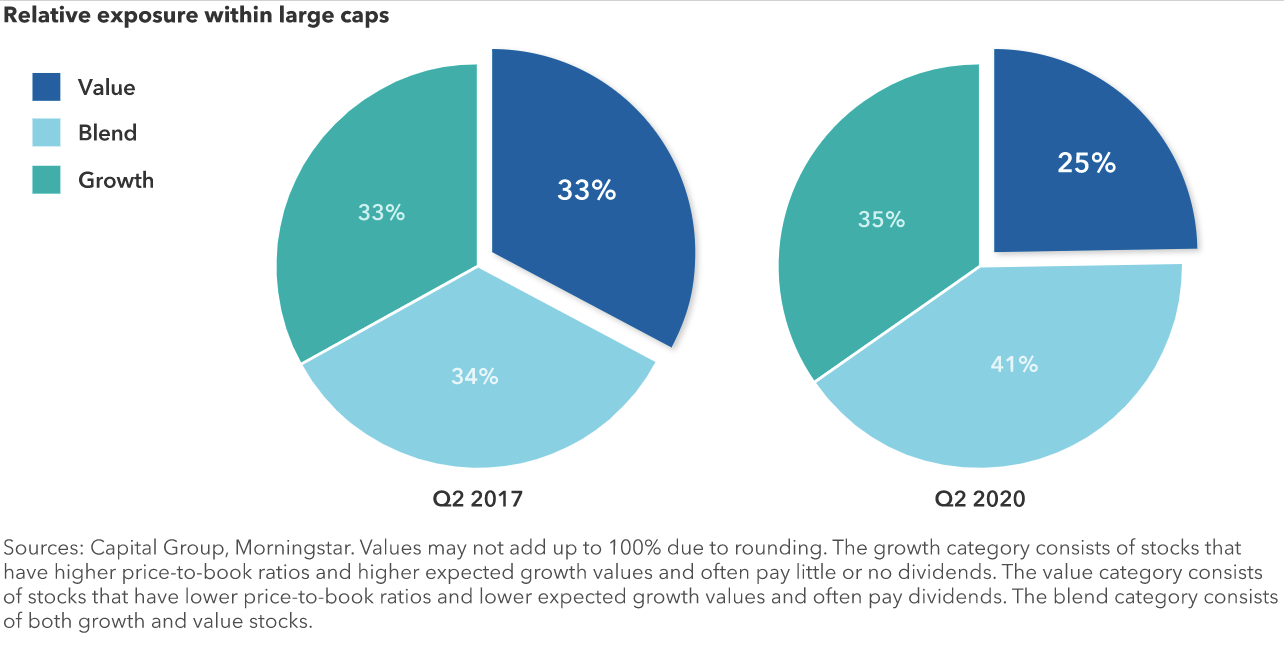

A review of more than 4,000 portfolios by Capital Group found that investors significantly reduced allocations to value equities over the last three years. It may be time to rebalance.

Returns for leading growth companies have continued to be strong, for good reason. But it may be shortsighted for investors to become seduced by the runaway growth stories, considering that many of the beaten down stocks in travel and other sectors have attractive valuations. And recently there have been some early signs that the market rally may be broadening as many of these stocks have posted meaningful gains.

Investors have scaled back their exposure to value funds

We just experienced a market downturn and recovery where the growth-oriented companies led during the decline and on the way back up. Historically, that is an unusual pattern. As the vaccines roll out and the recovery broadens we may begin to see companies in the travel industry, or perhaps energy or financials, all of which had been very hard hit during the downturn, participate in the recovery.

Are you on track for retirement?

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is a critical part of your journey to the retirement of your dreams. An experienced Financial Advisor can help you navigate the complexities of investment management. Talk to a Financial Advisor>

Dream. Plan. Do.

Platt Wealth Management offers financial plans to answer your important financial questions. Where are you? Where do you want to be? How can you get there? Our four-step financial planning process is designed to be a road map to get you where you want to go while providing flexibility to adapt to changes along the route. We offer stand alone plans or full wealth management plans that include our investment management services. Give us a call today to set up a complimentary review. 619-255-9554.