Rising fears over the continued spread of the coronavirus have led to a sharp stock market decline as investors grapple with its impact on the global economy. On Monday, March 9, in reaction to news of the virus spread and the recent oil shock, Standard & Poor’s 500 Composite Index fell 7.6%, triggering a 15-minute trading halt. As of March 12th, the Dow closed down 2,352, 10 percent.

How can we make sense of the coronavirus (COVID-19) outbreak and market reaction?

Until January 2020, most of us had never heard of this virus. People are understandably frightened because this is a new disease, and there is much uncertainty over how it will all play out. In short order, we have grown increasingly concerned about the prospect of a global pandemic and its impact on the global economy. First and foremost, the virus has a real human cost. We don’t know how many people are going to get ill or, worse yet, how many may die. Of course, our first thoughts are with the people who have fallen ill and their families.

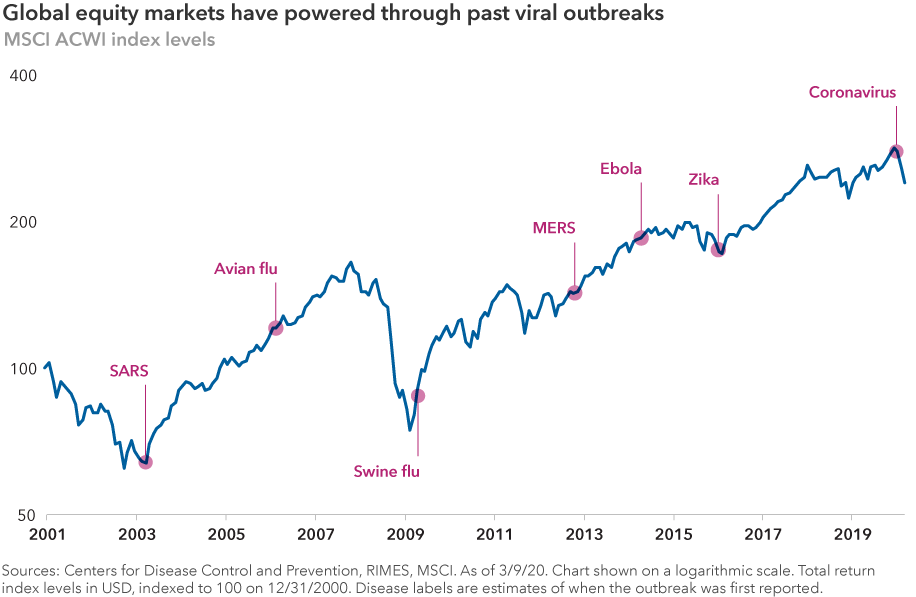

While this disease is new, there have been many pandemics and other crises in the past, and markets have survived them all. Today, a fair amount of panic has taken hold around the world, and we expect in the coming weeks that a rising number of cases may alarm many people. Eventually, the spread of the virus will slow down and people will get back to normalcy, as will markets.

What does this mean for the economy?

We are already seeing signs of a slowdown in the U.S., not only on the supply side as businesses brace for the road ahead, but also on the demand side. By now we have all heard of large conferences and entertainment events being canceled, firms postponing large meetings, and consumers delaying vacations and seeking to reduce their social contact.

That means businesses related to travel, leisure, entertainment and recreation are likely to be the most impacted, not to mention oil and other commodities where we have already seen a collapse in global demand.

On the positive side, the U.S. economy remains among the most resilient in the world. It has a history of bouncing back from adversity. Interest rates are low, and the decline in oil prices should further support the consumer. What’s more, in China the spread of the virus appears to have peaked. Given that, the peak of its spread globally will occur sooner than many people anticipate.

What does it mean for markets?

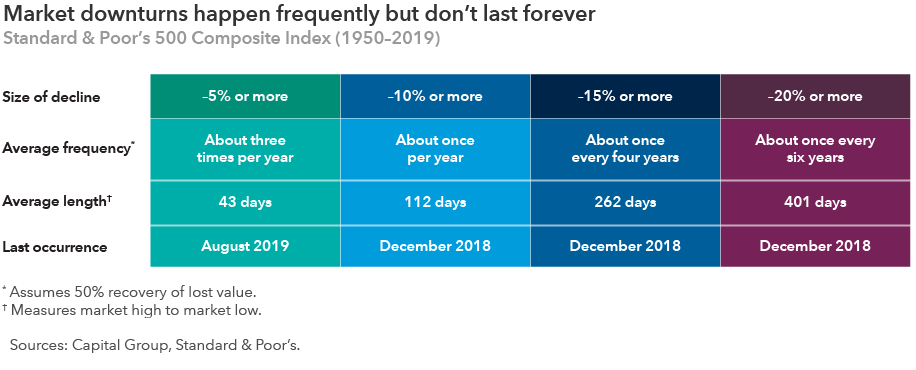

We are experiencing a market decline that we have not seen since the Great Recession. March 9, 2020 was the 11th anniversary of the market bottom during the Great Recession — and the market noted the anniversary by recording the largest single-day point decline we have ever seen. Three days later that was surpassed by the 2,250 drop in the Dow.

With this latest dip markets, as measured by the S&P 500, were down more than 20% from their peak earlier in the year, and we are now in a bear market. This would be the first bear market after more than a decade of generally strong market returns. As a result, in general, equities appeared to be fully valued by most measures heading into this recent period, and markets could remain volatile for some time. In addition to the uncertainty resulting from the spread of the virus, the U.S. is in an election year.

Turning to the bond market, we have seen a flight to safety that has pushed bond yields to unprecedented lows. The yield on the 10-year U.S. Treasury fell to 0.5%. Interest rates could go still lower as the U.S. Federal Reserve seeks to provide liquidity to markets through interest rate cuts and quantitative easing. Over time, low interest rates provide support to equities.

While the pace and magnitude of the recent volatility can be unsettling it is not entirely surprising. Investor sentiment is fragile and will likely remain so until the spread of the virus slows. In times like these, resilient investors who can demonstrate patience can be rewarded over the long term.

We take some comfort in seeing that the Federal Reserve has demonstrated its willingness to take aggressive action, cutting interest rates 50 basis points in an emergency meeting on March 3, which lowered its target range to between 1.00% and 1.25%. The Fed stated that it is “closely monitoring developments and their implications for the economic outlook, and will use its tools and act as appropriate to support the economy.” Markets are generally expecting an additional cut at the Fed’s next scheduled meeting, to be held on March 17 and 18.

How does this compare with crises in the past?

In the 25 years we have spent as fee-only financial advisors, we have experienced a number of unsettled markets, including the tech and telecom bubble in March 2000, and the Great Recession of 2008 and 2009. Each of these crises was very different, with very different underlying conditions. But in each case, the markets bounced back. We believe the markets, and great companies, will survive the current market decline and rebound.

One significant reason why there is such an extreme degree of bearishness, pessimism, bewildering confusion and sheer terror in the minds of advisors and investors alike right now is that most people today have nothing in their own experience that they can relate to, which is similar to this market decline. Our message to you, therefore, is courage! We have been here before. Bear markets have lasted this long before. Well-managed mutual funds have gone down this much before. And shareholders in those funds and the industry survived and prospered.

We have seen many turbulent markets and know how hard it is to avoid getting caught up in the here and now. This is especially true when the media bombards us hourly with news, speculation and rumor. We also know, though, that as long-term investors we must focus on the real world underneath the noise and mesmerizing flow of data.

Should investors expect a quick recovery?

Circumstances may very well get worse before they get better. But we believe eventually markets will rebound. This too shall pass. When it does, long-term investors who can tune out the daily white noise — and red numbers flashing across their screens — and focus on the long term should ultimately be rewarded.

We take the view that we will deal with outbreaks like COVID-19 and eventually we will adjust to it. At Platt Wealth Management, we are taking every precaution to prepare for it. We are working closely with clients, monitoring accounts. We are offering video and phone based meetings and we are reviewing our business continuity plan. We expect that we will be dealing with the COVID-19 virus, and are planning our operations around possible longer term considerations.

What is Platt Wealth Management doing to ensure continuity and care of client assets?

Obviously our first concern is to ensure the health and safety of our associates and clients. But rest assured as this situation evolves, we are working hard to continue to do what we have always done: working with clients to achieve their financial goals, looking for opportunities and making sure clients are confident with their investments. In-depth, long-term view of markets is at the core of what we do. We will do our very best to provide clients with a smooth and less volatile experience than the broader markets.

What should investors be doing?

In periods of declining markets, emotions run high, and that’s natural and understandable. But it is exactly in times like this that a long-term orientation is important. Based on our prior experiences and what has historically occurred, we firmly believe markets will rebound and life will return to normal or what may be a new normal. Now more than ever, investors should be in close communication with their advisors, reaffirming their long-term objectives.