Q1 CLOSES HIGH

The S&P 500 was up 6.17% 1st quarter of 2021. The Wilshire 5000, an index that tracks all actively traded US stocks, was up 2.54%.

The Russell 2000 Value Index returned 21.17% outperforming the Russell 2000 Growth Index at 4.88%.

1st quarter of 2021, energy and financials outperformed both technology and communications services, a reversal from 2020.

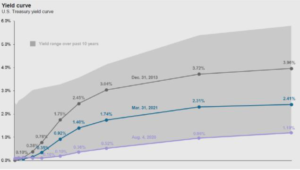

The 10-year Treasury yield began the year with a rate of 0.93% and ended the quarter at 1.74%. The 30-year Treasury yield began 2021 with a rate of 1.66% and ended the quarter at 2.41%.

INTEREST RATES

In the bond markets, rates on longer-term securities jumped from historically low rates to simply low rates. Last year at the end of the first quarter the 10-year Treasury yield was 0.70% and the 30-year rate was 1.35%. They finished the year higher at 0.93% for the 10-year and 1.66% for the 30-year. This past quarter they moved considerably higher with the 10-year at 1.74% and the 30-year Treasury at 2.41%. These are sizable changes from when the economy was suffering from a rapid slowdown in business activity.

Concerns from investors through the quarter were not due to a 2.41% yield on the 30-year Treasury. Instead, the problem stems from the speed at which the treasury yields have increased. Increasing bond yields tend to have a negative effect on growth stocks, while value tends to outperform in these environments. Rising rates lead to lower prices on fixed-income securities. This will be a concern going forward. The Federal Reserve continues to support “keeping rates lower for longer” during the economic recovery.

Graph by JP Morgan

VALUE VERSUS GROWTH

Value versus growth investing has been and always will be a topic of debate. However, over the last decade, growth has outperformed value with large-cap growth, mid-cap growth, and small-cap growth outperforming their value counterparts.

While the performance of growth stocks has been undeniable, there comes the point where the pendulum begins to swing in the other direction. Through the 1st quarter of 2021, we saw a rise in interest rates and a cooling off of big-name growth stocks. For the quarter, large-cap value, mid-cap value, and small-cap value significantly outperformed their growth counterparts—a big shift from the past 10-years. As the economy heals, we could see sustainable momentum in the value investing strategy as investors seek out companies positioned to capitalize on an economic re-opening.

UNEMPLOYMENT

The unemployment numbers immediately following the beginning of the Coronavirus Pandemic were staggering. In April of 2020, unemployment levels hit 14.8%, the highest rate since the great depression. As of the end of the 1st quarter of 2021, the unemployment rate was 6.2%, which is a significant improvement and positive sign going forward. For context, the 50-year average unemployment rate is roughly 6.3%. If a compromise can be reached on an infrastructure plan, unemployment numbers will further improve over time.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

COVID-19 AND VACCINATIONS

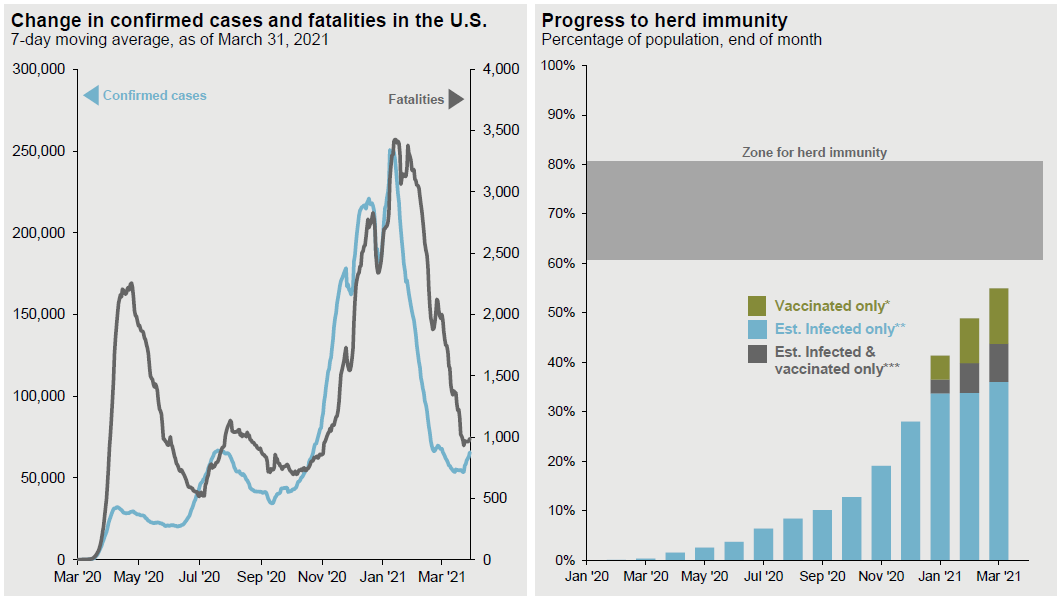

Cases and fatalities from the Coronavirus have decreased rapidly over the past few months. This has been due to an effective roll-out of vaccinations and advancements in therapeutics. For example, at the beginning of the year, the 7-day average for new cases in the United States was roughly 250,000. But by March 31st, 2021, the 7-day average was about 64,400 new cases.

On the vaccine front, per the CDC, approximately 110,000,000 Americans have received at least one dose of the vaccine, making up roughly 33% of the population (as of April 7th, 2021). While 64,400,000 million Americans are fully vaccinated, approximately 19% of the population (as of April 7th, 2021). While there is still much work to be done, we may be beginning to see the light at the end of the tunnel.

Graph JP Morgan

YOUR PORTFOLIO AND YOUR GOALS

We look forward to meeting with you and taking the time to make sure you’re on track to achieve your goals. It’s always a good idea to revisit your asset allocation to make sure you are invested in a portfolio that is right for you. The proper asset allocation enables you to stay the course when challenging market environments occur. We also want to know if anything has changed recently that could impact your financial future. Platt Wealth Management is here to serve as your financial resource. Please reach out to us with any questions or concerns.

Warmest regards,

Platt Wealth Management