2025 2nd Quarter Investment Management

March Winds and April Showers Bring Forth May Flowers

The S&P 500 was up 6.15% in May and followed that with an increase of 5.1% in June, close to its all-time high. It ended the quarter up 10.94% and 6.20% for the first two quarters of 2025. Big is still better, as the small cap Russell 2000 Index was up 8.5%, but negative for the first six months of the year with a loss of 1.79%. Foreign stocks extended their winning ways with a gain of 10.58% in Q2.

Federal Reserve Stays the Course

Financial markets are betting the data dependent Federal Reserve will most likely not make a cut at its July meeting.

Federal Reserve Chairman Jerome Powell told Congress last month that, “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

The futures market anticipates two cuts before the end of the year. The Fed, however, will make the number and size of the cuts based on its outlook for inflation and the prospects for economic growth. Deterioration in the economic outlook, such as weakness in the labor market, could accelerate rate cuts. While the unemployment rate remains low at 4.2%, leading indicators of job growth are pointing to a cooling labor market, with jobless claims now at their highest level since November of 2021.

Inflation and Tariffs

Inflation continues above the Fed’s 2% target. Prices in the U.S. rose 2.3% in May compared with a year ago, up from just 2.1% in April. Excluding the volatile food and energy categories, core prices rose 2.7% from a year earlier, an increase from 2.5% the previous month. Inflation is expected to rise if the tariffs become too onerous. The added costs will end up being paid by someone along the supply chain — whether it is manufacturers, retailers, or consumers.

The One Big Beautiful Bill Act (OBBBA)

Just after the end of the quarter, on July 4, Congress passed new tax legislation. It permanently extends the individual tax rates of 2017. The SALT (state and local tax deduction) cap was raised from $10,000 to $40,000 (for taxpayers making less than $500,000). The bill includes temporary tax deductions for tips, overtime pay, and auto loans for certain cars made in America. However, it raises the debt ceiling by $5 trillion. It also makes significant cuts to Medicaid spending of about 12%. The OBBBA includes new defense spending of $150 billion and another $150 billion for border enforcement.

The Congressional Budget Office (CBO) estimates the budget deficit will increase by about $3 trillion in 2034 and that nearly 11 million Americans will lose health insurance coverage.

The jury is still out on whether the bill and tariffs will spur manufacturing and economic growth at home. However, what it does accomplish is to bring certainty and closure to other outcomes. Markets loathe uncertainty and we now have policy clarity with the passage of the One Big Beautiful Bill.

Our Contact Information

3838 Camino del Rio North

Suite 365

San Diego, CA 92108

619.255.9554

Planning Ahead

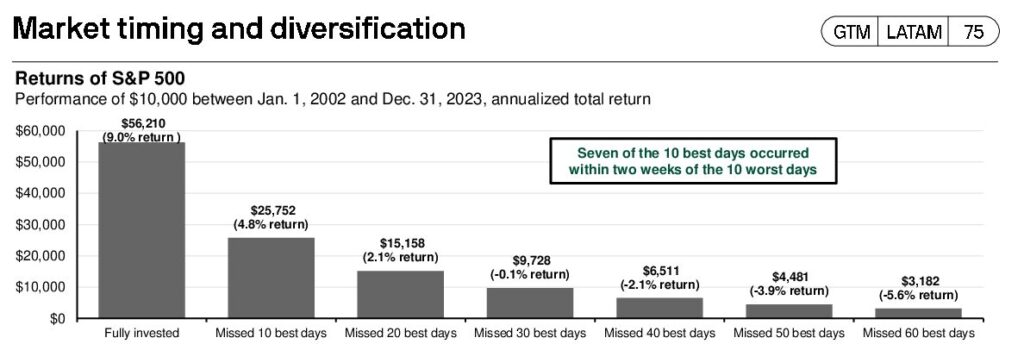

The market’s rebound from April lows is encouraging, yet significant headwinds remain for economic growth. With tariff uncertainties, global tensions, and market volatility, it is crucial to stay focused on your long-term goals. Investing success comes from thoughtful strategy, as opposed to market timing. Volatility is part of the process.

We continue to navigate this dynamic environment through disciplined portfolio management and asset allocation while implementing portfolio rebalancing, asset location, and tax loss harvesting. Please do not hesitate to reach out to us if you have any questions about your portfolio.

Best regards,

Your team at Platt Wealth Management