2021 OUTLOOK

GDP GROWTH

The International Money Fund (IMF) estimates global GDP will rise by 5.2% in 2021. Emerging markets GDP growth is projected at 6%, with Eurozone at 5.2%, and the United States at 3.1%. These projections bode well for diversified portfolios with international exposure. Vanguard has similar projections for the Eurozone and emerging markets, although slightly greater estimates of 5% for the U.S. They anticipate, however, superior returns from international equities because of their higher dividend yield and lower valuations.

COVID AND VACCINES

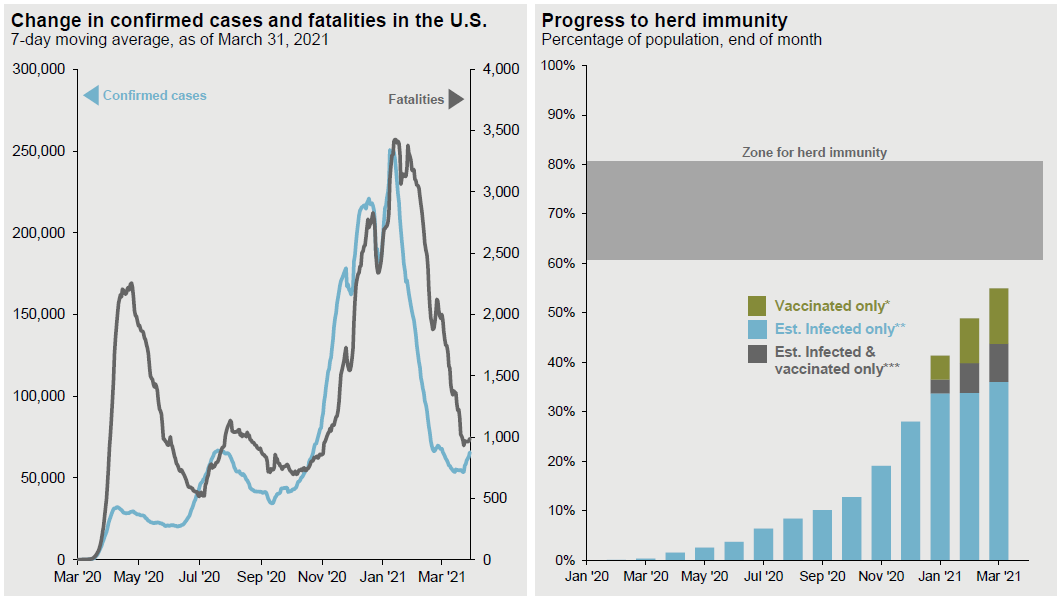

Growth estimates are based on the successful rollout of vaccines. Unfortunately, we already see signs that this will take longer than hoped for. It appears infection immunity will be more likely in Q3 or Q4 of 2021.

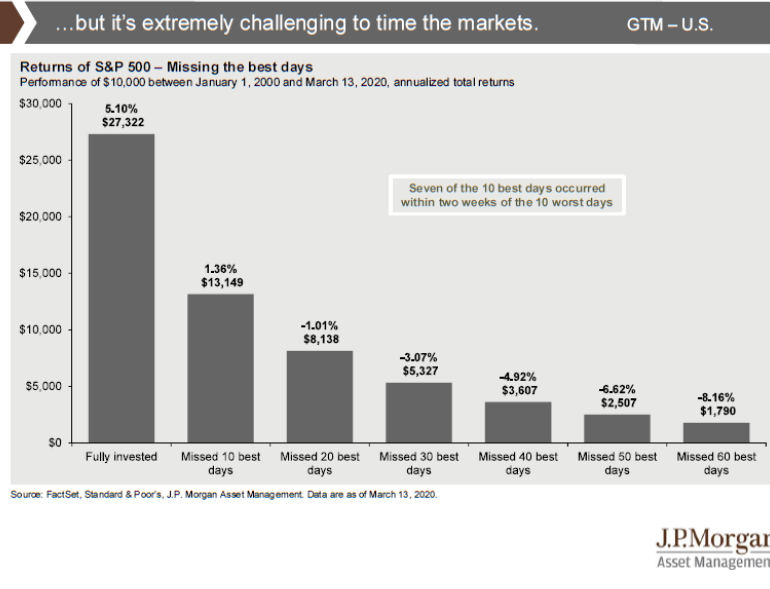

2020 reminded us that, as we have always said, you cannot time the market. At the end of Q1 most major Wall Street firms were lowering their expectations for the markets. Goldman Sachs slashed their year-end target for the S&P 500 to 3,000 in March. They later raised it to 3,600 in August, then increased it again to 3,700 in November. It finished the year at 3,756.

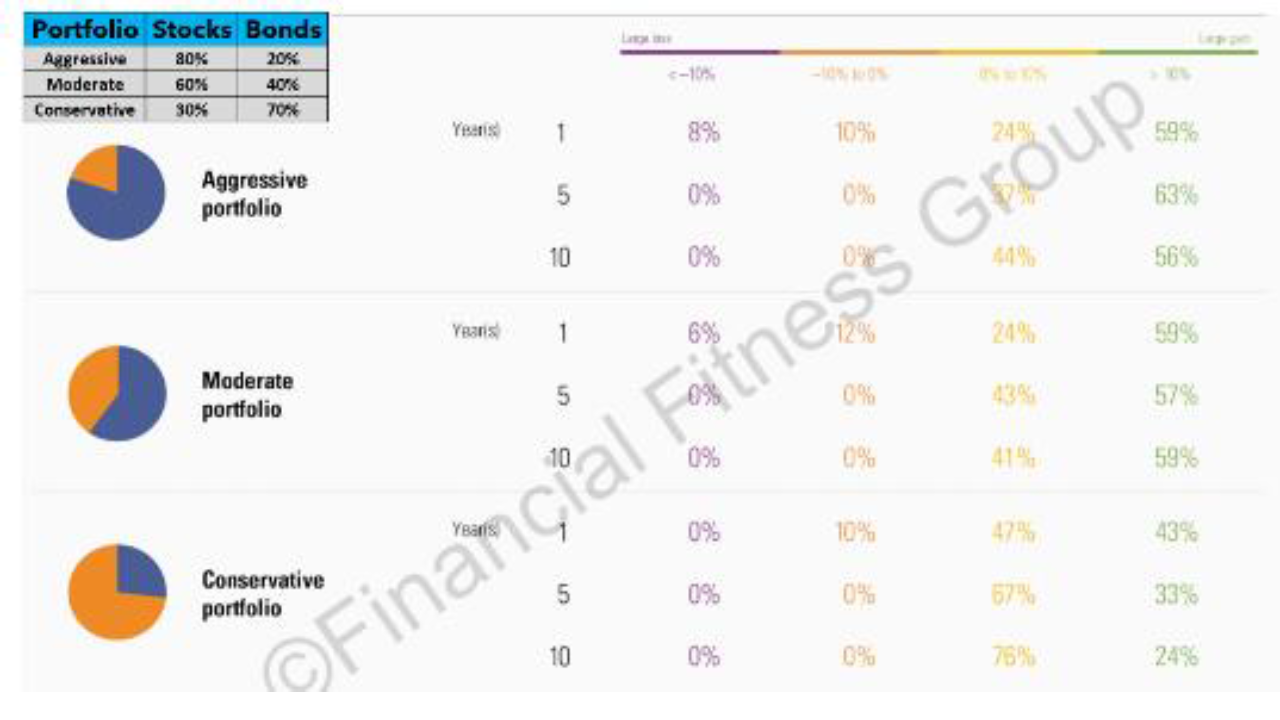

We have always stressed that the right portfolio asset allocation is the one that you will not abandon during difficult times, and these were certainly difficult times. Headlines foresaw the end of the world. But as many of you have heard me say, “Statistically speaking, the end of the world does not happen that often.”

Knowing that you are still on track to achieve your goals can give you peace of mind during this tumultuous period. If you wish to discuss your portfolio or any other financial matters, please contact us for a phone call or virtual meeting.

Warmest regards,

Platt Wealth Management